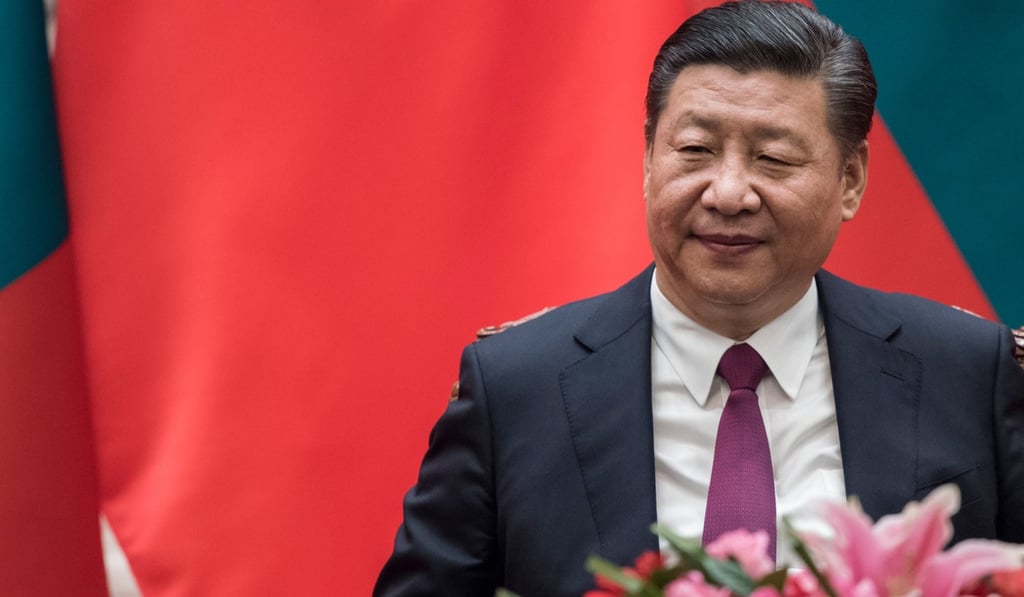

Xi Jinping’s war on shadow banking spills over, rocking China’s wider financial world

Companies that had committed to buying overseas assets are now finding it hard to complete the deals amid China’s financial clean-up of its shadow banking activities and banks’ reluctance to extend loans

Beijing’s tightening rein on shadow banking activities, under President Xi Jinping’s call to tame risks, is opening a can of worms in the country’s wider financial realm as deals are falling apart and debts remain unserviced.

As banks refuse to roll over debts, shadow lending channels blocked and the value of pledged shares of listed companies shrinking, deals that were once regarded as good are quickly turning sour.

James He, a senior executive with a Beijing-based manufacturing and health conglomerate, is one of those caught off guard by the change.

He, who declined to name his company for fear of causing a sell-off in related shares, told the South China Morning Post that his firm had decided to invest abroad when money was easily available and its share price was high.

It borrowed money at home and paid US$30 million as deposit for taking over a mid-sized Hollywood film studio in early 2017 – at a time when it was trendy for Chinese enterprises to buy trophy assets such as landmark buildings, sports clubs and studios.

Dalian Wanda, Anbang Insurance Group and HNA Group were grabbing headlines on a near daily basis with their acquisition plans.