AgBank plans US$16.8b recapitalisation drive alongside China banking regulatory move

Agricultural Bank of China times its move with regulators’ plans to allow banks more ways to replenish their capital

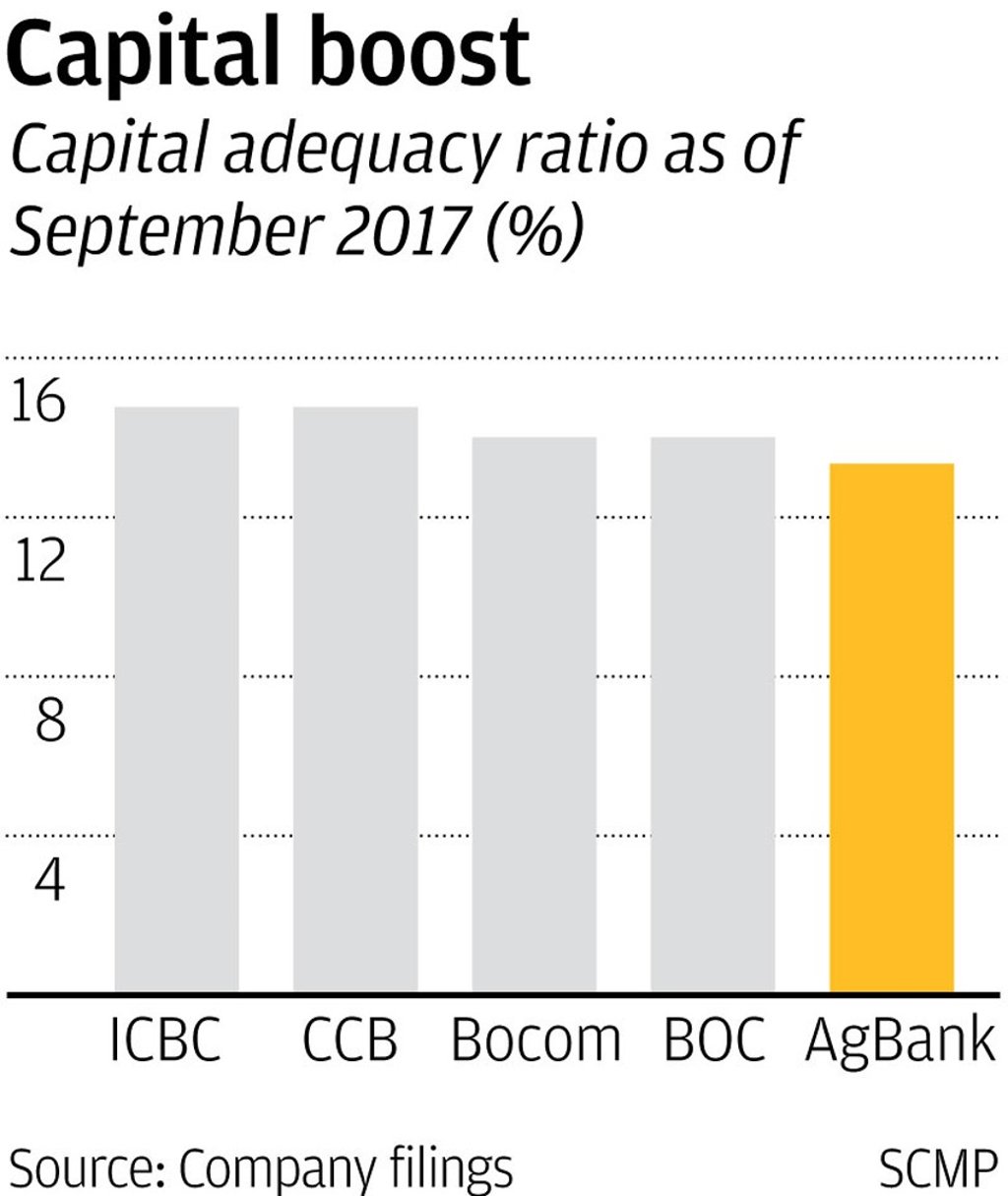

The Agricultural Bank of China, the least capitalised of the country’s five top lenders, announced the biggest replenishment of capital by a Chinese company with its 100 billion yuan (US$15.8 billion) stock sale, the same day the regulator cleared the way for financial institutions to use new methods for raising funds.

AgBank said in a stock exchange filing late on Monday that it plans to sell up to 27.5 billion shares to seven major institutions, including the Finance Ministry, Central Huijin Investment and China National Tobacco Corp, a move that will help shore up its tier 1 capital and boost capital adequacy.

China’s third-largest lender announced the plan soon after the nation’s top five financial regulators posted a joint statement, noting that they will give commercial banks more leeway to replenish capital by way of more tools, channels and markets, investor eligibility and fewer red tape.

The statement was jointly released by the central bank, the top regulators of banking, insurance, securities and foreign exchange on the China Banking Regulatory Commission (CBRC) website on Monday, but backdated to January 18.

The measures are not in isolation, analysts said, as they reflectBeijing’s aim to alleviate capital pressures on commercial banks and defuse financial risks by trimming leverage levels and clearing irregularities, which are driving off-balance sheet assets back onto banks’ books and put pressure on banks’ capital.