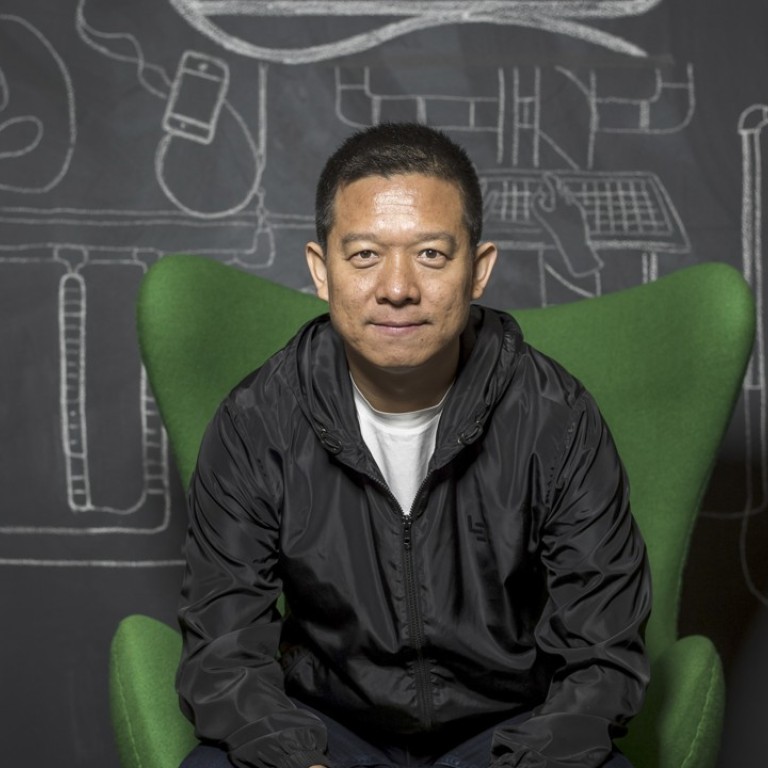

LeEco founder Jia Yueting receives financial lifeline from mystery Hong Kong investor

Struggling Chinese businessman Jia Yueting, who is on a nationwide blacklist of debt defaulters, has received a funding lifeline from a mysterious Hong Kong investor, Caixin reported.

Shi Ying, a British Virgin Islands registered company, has agreed to invest US$2 billion into Jia’s company Faraday Future, in several tranches, for a 45 per cent stake of the company.

Jia founded Faraday Future in 2014 in Los Angeles, to build electric cars that could challenge Tesla.

The company’s operations in Nevada were shut late last year as Jia struggled to keep his cash-strapped business empire afloat.

Following the latest capital injection, Jia will hold 33 per cent of Faraday Future, while the remaining 22 per cent will be owned by management.

The first tranche worth US$550 million has been injected to the company, Caixin reported on Wednesday, quoting Shi Ying’s director Jackie Wah Wang Kei.

Shi Ying is controlled by Hong Kong businessmen Chiu Tao, who also owns two listed companies, including CST Group Limited, and G-Resources Group.

Chiu has close ties with property tycoons, including Hui Ka-yan, chairman of China’s biggest developer Evergrande Group, and Joseph Lau Luen-hung, the controlling shareholder of Chinese Estates Holdings, Caixin reported.

Smart Mobility Auto, a company under Faraday Futures, earlier in April won a bid for a land plot covering 98.8 acres in the Nasha district, Guangzhou.

The Shenzhen Stock Exchange had issued several inquiries to Leshi Internet Information & Technology, a listed firm founded by Jia, questioning his relationship with Smart Mobility. In a written reply on Thursday, Leshi said it “could not make sure whether the funds used to purchase land has direct or indirect ties with Jia and unpaid debts”.

Jia, who famously referred to Apple as “outdated and losing momentum in China” in an interview with CNBC in April 2016, sought to build a “LeEco ecosystem,” where he could cross-sell content, films, TV shows to owners of LeEco cars and televisions.

But in late 2016 the business began to crumble as the rapid expansion left it short of cash. Shares of his Shenzhen-listed flagship Leshi Internet Information & Technology resumed trading in January following a suspension that began in April.

Jia has remained in the US since July despite repeated requests from China’s regulators for his return.

Leshi is due to repay 5.6 billion yuan (US$892.3 million) of loans by year end, while an additional 7.2 billion yuan of unpaid receivables is due from other unlisted LeEco units.

Jia remains the biggest shareholder of Leshi, although almost all of the stake has been frozen by local courts at the request of creditors.

Jia was put on a credit blacklist by the authorities in December, which blocks him from borrowing from banks, or even buying railway tickets.