Huawei is in better shape to withstand US pressure, thanks to industry’s largest research budget

Huawei Technologies, China’s largest telecommunications equipment and smartphone maker, has tried for many years to break into the US market, to little avail.

With a trade spat escalating between the US and China, and fresh from American phone networks AT&T and Verizon withdrawing their support of the Chinese brand – most handsets sold in the US are subsidised by carriers – that dream appears further out of Huawei’s reach.

Just how important is the US for Huawei, which is already the world’s third-largest smartphone maker by sales?

“Realistically, Huawei doesn’t need the US, given its strong market in China, and its increasing market share in Asia, Europe and Africa,” said Paul Haswell, a partner at the global law firm Pinsent Masons.

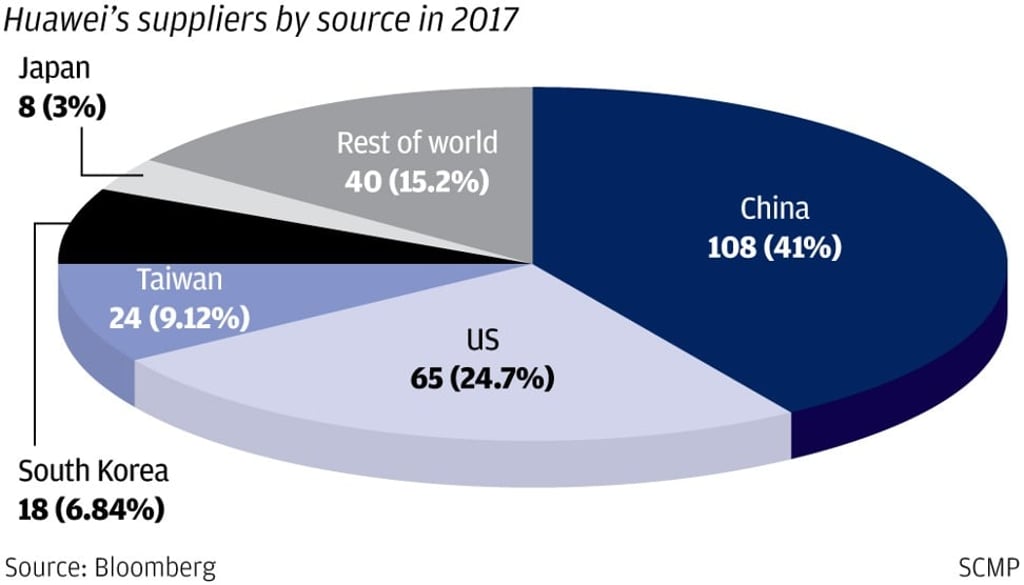

The world’s largest economy may be important for Huawei for a different reason: hardware components and software.