Ping An Good Doctor prices US$1.12 billion IPO at top end amid retail frenzy

Flotation, Hong Kong’s biggest this year, overbought by more than 650 times by retail investors

Ping An Good Doctor, China’s largest online medical services app, has priced its closely watched initial public offering at the top end of its price range. It hopes to raise HK$8.77 billion (US$1.12 billion) after its flotation, Hong Kong’s biggest in 2018, was overbought by more than 650 times by retail investors, making it the city’s most sought-after main IPO since 2009.

Good Doctor, formally known as Ping An Healthcare and Technology, has priced its IPO at HK$54.8 a share, which is the top end of the HK$50.8 to HK$54.8 price range, according to people familiar with the matter.

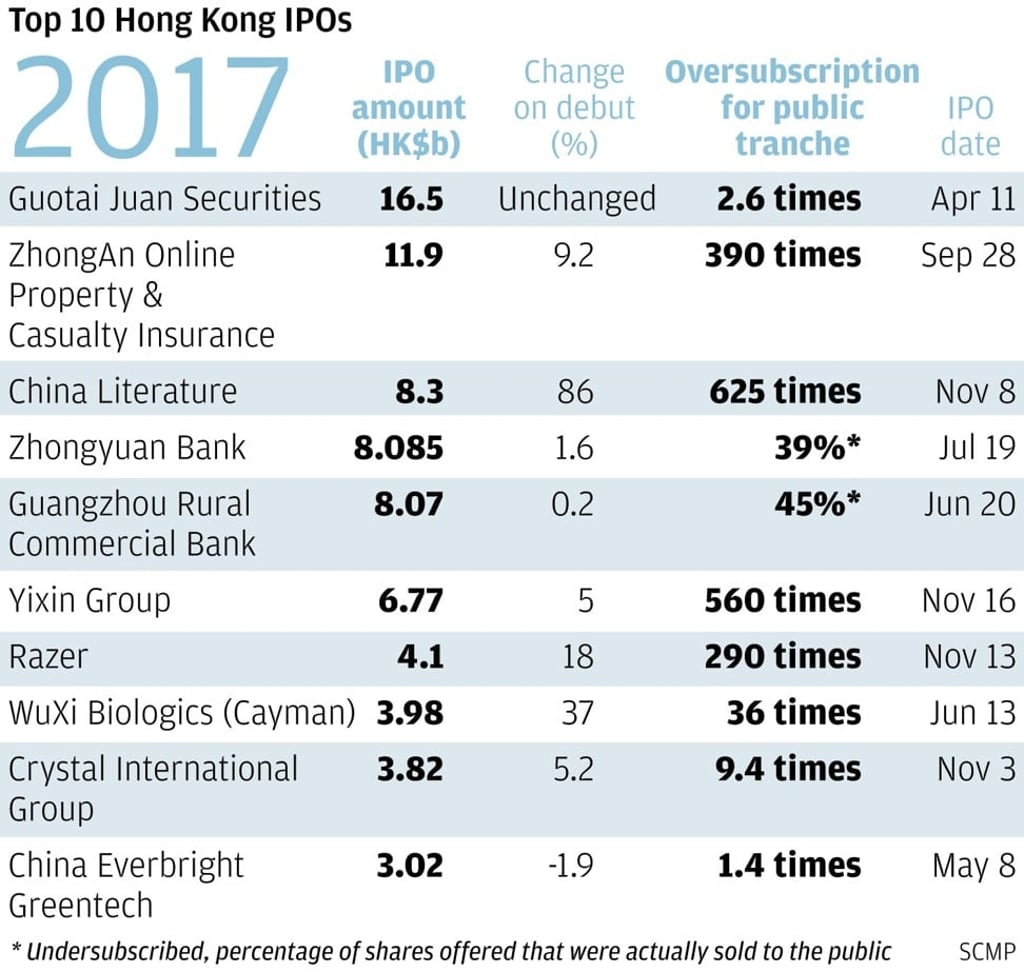

The flotation, the first by a unicorn in Hong Kong this year and also the biggest in value, has attracted retail investor demand that is 653 times more than the number of shares on offer, exceeding China Literature’s retail oversubscription rate of 625 times, the most among main IPOs in the past nine years. In July 2009, Chinese property developer BBMG’s share offering was oversubscribed by 782 times.

The international placing tranche was also “massively” oversubscribed, sources told the South China Morning Post.

Good Doctor plans to sell 160.094 million shares in total, and had initially set aside 6.5 per cent for retail investors. But the huge oversubscription for its public offering has triggered a so-called clawback clause, which will enable underwriters to reallocate shares to retail investors from institutional investors, and increase the retail tranche to 25 per cent.