China focused UK-based maker of affordable DNA sequencing kits eyes Hong Kong listing

Oxford Nanopore Technologies, spun-out from Oxford University, is aiming to take on US-based rival Illumina in the US$3 billion a year market by focusing on China, which accounts for 80 per cent of the world’s projects sequencing new genomes of animals and plants

Oxford Nanopore Technologies, an affordable DNA sequencing devices supplier seeking to break the stranglehold of US rival Illumina in China, is considering a dual London-Hong Kong listing in the next 18 months, according to its chief executive.

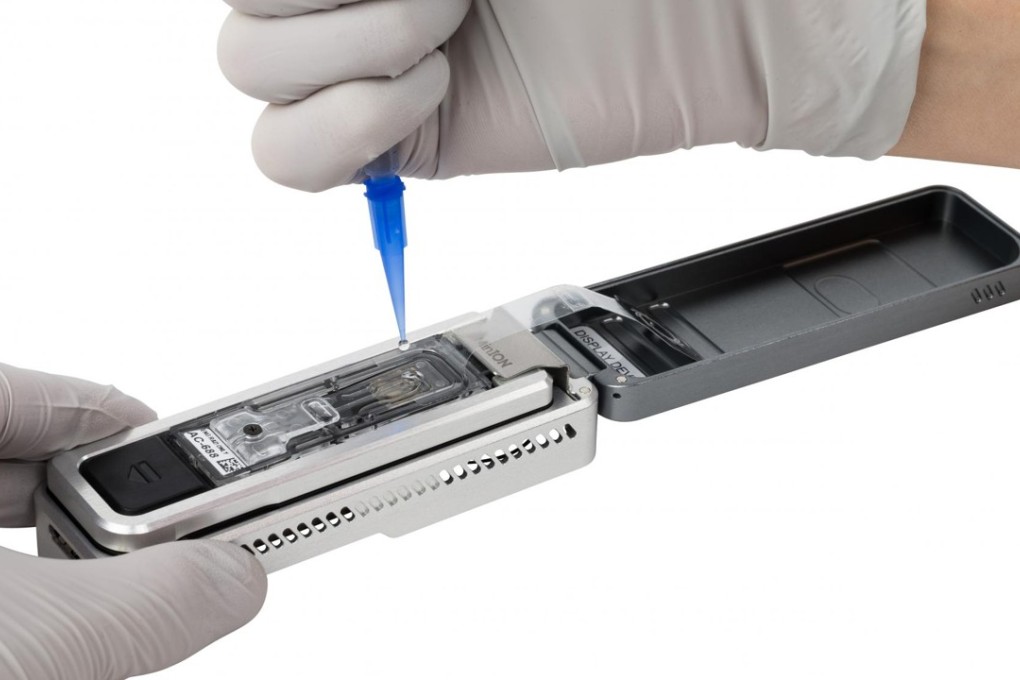

The Oxford-based company, spun-out from Oxford University in 2005, is seeking to grab a slice of theUS$3 billion a year global market, in which Illumina has a 90 per share market share, by offering “starter pack” sequencers at US$1,000 to a much more sophisticated device valued at US$160,000, said Gordon Sanghera.

Prices of Illumina’s machines range from US$20,000 to US$10 million.

“Our goal it to give every single biologist the ability to analyse DNA, to check what they are doing in real time at their desks,” said Sanghera, who earlier played a key role in bringing to diabetics a finger-stick blood glucose testing device developed by Medisense, another Oxford spin-out acquired by US health care major Abbott.

“Our model is to completely disrupt [the current pricing model] by offering the devices for free and only charge for the consumables.”