Xiaomi IPO gets lukewarm reception as institutional investors question pricing

Founder Lei Jun says smartphone maker should be valued as a ‘hybrid of Tencent and Apple’ as investors question IPO pricing

Xiaomi’s initial public offering was met with a lukewarm response by institutional investors, many of them put off by what they see as a high valuation based on the company’s claim that it is an “internet company” rather than a hardware maker.

Lei Jun, the entrepreneur who took the company from a start-up to world’s No. 4 phone maker, said on Thursday Xiaomi should be valued as high as “a hybrid of Tencent and Apple”.

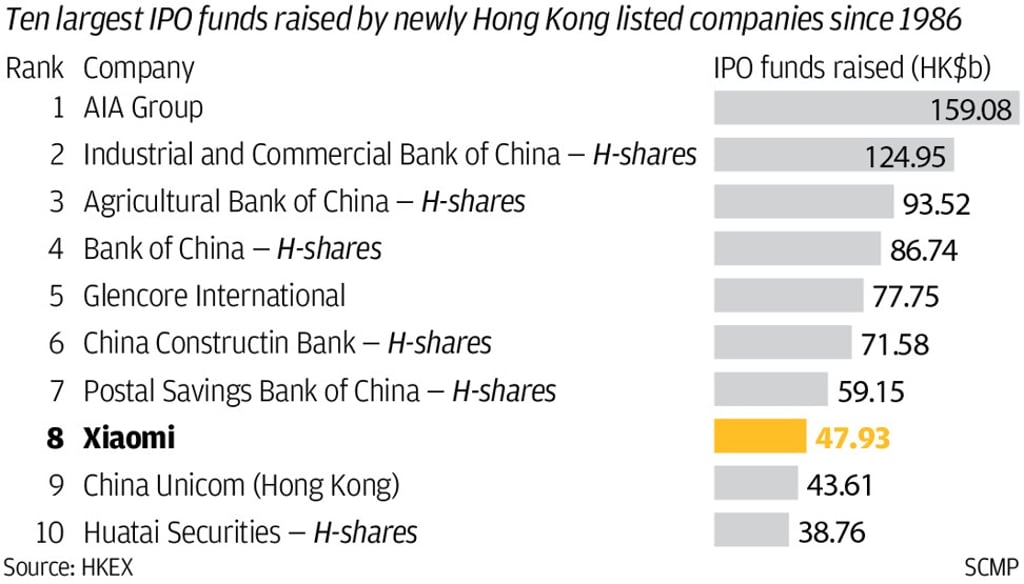

The Chinese smartphone maker started taking orders from institutional investors on Thursday for its US$6.1 billion Hong Kong offering, the biggest technology IPO in the world since Alibaba’s US$25 billion listing in 2014. The flotation is also the largest in Hong Kong since Postal Savings Bank of China raised US$7.4 billion in 2016.

Xiaomi plans to offer 2.18 billion shares in an indicative price range of between HK$17 to HK$22. Only 5 per cent are for public sale, while the rest are targeted toward global institutional investors.

The share price would value the company in a range between US$54 billion and US$70 billion, well short of its initial target of US$100 billion.