Xiaomi offers itself as ‘new species’ as it allays doubts to justify US$6.1 billion stock sale

CEO Lei Jun says the smartphone giant is a “new species” of company because it’s a hardware maker that also makes money from internet services

Lei Jun, the entrepreneur who took a mere seven years to create the world’s fourth-largest phone maker, put on a brave face as he presented the largest global stock offer of 2018 to retail investors, even as he pushed back against the Chinese government’s strong-arm tactics to split his fundraising.

Xiaomi, the Chinese smartphone maker that went from start-up to 100 billion yuan (US$16 billion) in global sales in seven years, represents a “new species” of company in the technology industry because it’s a hardware maker that makes money from internet services, Lei said during a 90-minute presentation at the Four Seasons Hotel in Hong Kong.

“Xiaomi is a new species, in a class of its own,” Lei said in Mandarin Chinese. “Rather than explaining whether it’s a hardware maker or an internet firm, I would say Xiaomi is an all-rounded company that can do well in all three aspects of hardware, e-commerce and retail, and internet services.”

The identity of the company, whose name means millet in Chinese, is the crux in Lei’s plan for tapping the global markets for capital, and for turning his Beijing-based company into a global player.

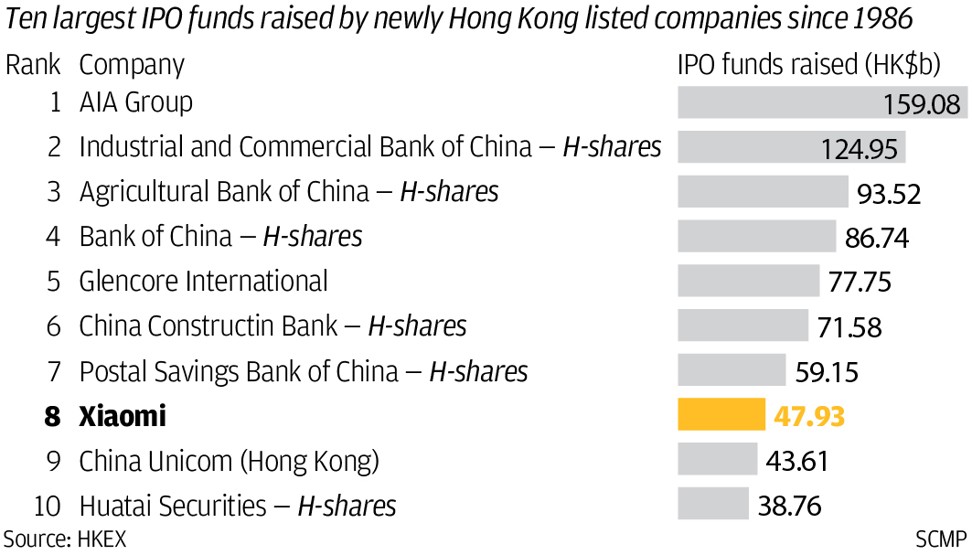

Xiaomi will offer 2.179 billion shares at between HK$17 and HK$22 billion each on June 25, raising up to HK$47.95 billion (US$6.1 billion) in Hong Kong, valuing the entire company at between US$54 billion and US$70 billion. The world’s biggest IPO this year will begin trading on July 9, according to a press release.

Lei, who turns 49 in December, has had a challenging time convincing investors to buy into his business model, which he dubs the “triathlon” of technology.

It works this way: Xiaomi would sell hardware at a profit margin capped at 5 per cent, using an efficient and cost-effective new retail channel to attract as many users as possible. The company would then provide engaging internet services for users, to create new sources of revenue.

“A honest man won’t be too unlucky because fortune favours fools,” Lei said, citing a Xiaomi employee in his corporate video.

In 2017, Xiaomi derived only 8.6 per cent of sales from internet services, but with more than 60 per cent gross profit margin. Sales from smartphones and devices accounted for over 70 per cent and 20 per cent respectively, the gross profit margins of which are both below 9 per cent.

“Internet services is and will continue to be our major source of profit,” Lei said.

Another source of profit is Xiaomi’s ecosystem of more than 200 companies such as online video platform iQiyi and wearable device maker Huami, both of which have already been listed in the US. Lei, a serial entrepreneur, has personally groomed and taken several technology companies public.

“There’s room for Xiaomi to grow tenfold in the foreseeable future, ” Lei said, singling out three drivers - continued growth in smartphones, smart hardware such as televisions and laptops, both in the world’s most populous nation and beyond China. Xiaomi claimed the largest share of India’s smartphone sales in the first quarter.

“We have entered 74 countries, while there are so many more waiting for us,” he said. “We will continue to expand around the world.”

Xiaomi will be the first dual-class technology companies, the so-called weighted interest entities, to list in Hong Kong, after the city’s regulator and market operator last year overhauled their fundraising regulations to compete with New York and Chinese bourses as the global hub for IPOs.

The new rules allow Lei to exert majority control of his company, even if he owns a minority of the shares. Lei, who holds a 31.4 per cent stake in Xiaomi, received on April 2 from his board 639.6 million Class B shares valued between HK$10.87 billion and HK$14.07 billion, in what The Wall Street Journal called one of the largest executive bonus in world history.

Hong Kong wasn’t alone in wooing Xiaomi. China’s securities regulator, anxious to offer more investible options to Chinese investors, had been persuading the smartphone maker to pioneer a form of Chinese depository receipts (CDRs) in Shanghai ahead of its Hong Kong IPO.

In a surprise pushback, Xiaomi announced on Tuesday its decision to postpone the CDRs, opting instead to raise capital in Hong Kong first.

“CDR is a major innovation [in China’s capital market],” said Xiaomi’s chief executive officer Chew Shou Zi, adding that the postponement was mutually agreed with the Chinese regulator. “We support it and feel a great honour to be one of the first group of companies to try this, as it reflects the recognition by the regulator of our status. But after several months of hard work to ensure the success of the CDR trial, we have decided to go public in Hong Kong first, and pick an appropriate time to issue CDRs at a later stage. ”

Xiaomi had intended to use 30 per cent of the proceeds for research and development, 30 per cent to expand and strengthen its capability in the so-called internet of things, 30 per cent for global expansion, and the rest for working capital and other corporate purposes.

Still, the company remains committed to its business model, which puts a 5 per cent limit on the profit margin of every piece of hardware - from smartphones to suitcases and ballpoint pens - that it sells.

“We want customers to feel that our price is honest,” Lei said. “What we are after is the customer’s heart, more than the profit.”

“Good companies earn money,” he said. “Great companies earn trust. Xiaomi wants to become a great company.”

With additional reporting by Xie Yu and Yingzhi Yang in Hong Kong

This story was amended to correct a reference to the entire value of Xiaomi once the final pricing of its shares is known.