JPMorgan goes on a hiring spree to retool its China banking team for serving technology unicorns

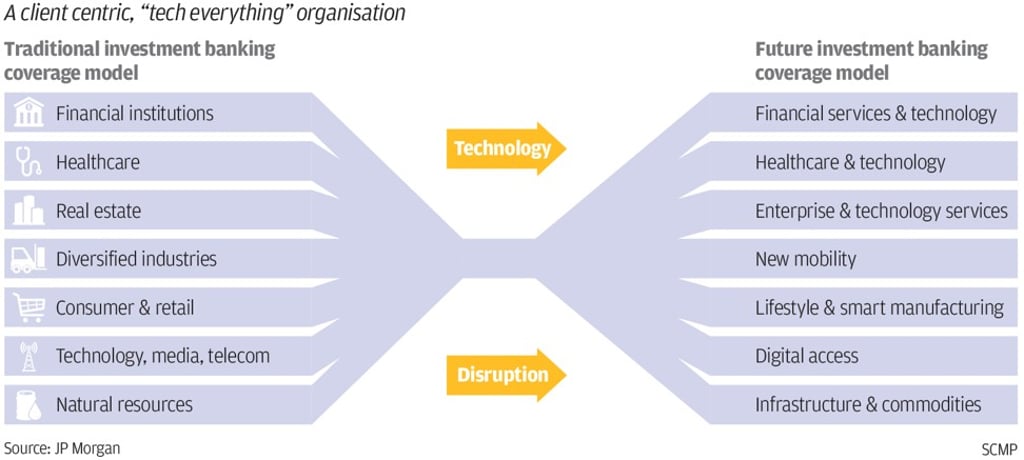

The reorganised China team will expand its workforce by up to 50 per cent, dividing the structure into seven new sectors: financial services and technology, health care and technology, enterprise and technology services, new mobility, lifestyle and smart manufacturing, digital access, and infrastructure and commodities

JPMorgan Chase & Co. said it’ll go on a hiring spree over the next three years, as it reorganises its China investment banking team into additional categories to serve so-called new economy companies that are expected to raise up to US$200 billion in capital over the next few years.

“The new economy in China is newer than, and very different from, many economies in the West,” said the bank’s co-head of Asia-Pacific investment banking Murli Maiya, aiming to turn the team into a “tech-everything” organisation. “In three to four years, our bankers would be obsolete, as our clients change in a way they can’t understand, so we have to force the change here. ”

The hiring also forms part of its plan to build a securities business onshore in China, once it is approved by local regulators. In May, the bank applied for approval to set up a majority-owned securities company in China.

The reorganisation of its China team, which began earlier this month, will expand its workforce by between 40 per cent and 50 per cent, while dividing the current structure into seven new sectors, comprising financial services and technology, health care and technology, enterprise and technology services, new mobility, lifestyle and smart manufacturing, digital access, and infrastructure and commodities.