Wheelock ends 57-year history as public company as shareholders approve HK$126 billion privatisation plan

- Billionaire Peter Woo’s privatisation plan is approved by 99.87 per cent of shareholders at a vote on Tuesday

- The stock’s last day of trading on the Hong Kong exchange is on June 18, company says

More than 99 per cent of Wheelock’s shareholders consented to the plan at a meeting on Tuesday, the company said in an exchange filing. The stock will trade for the last time on June 18, it added.

Wheelock, controlled by billionaire Peter Woo Kwong-ching, has been rangebound over the past three years. The stock has declined by about a quarter from a high in March 2017 by the time the take-private deal was announced. The company cited its low stock price relative to its asset backing among the reasons for the privatisation.

Chairman Douglas Woo Chun-kuen, the son of Peter Woo, thanked shareholders for their support in front of dozens of investors who convened to vote for the deal on Tuesday at a hotel ballroom in Tsim Sha Tsui.

“No matter what the result is, I’m very grateful for the support from all of the shareholders over the years,” he said. “The company is only able to come this far because of you.”

Investors who attended the meeting expressed mixed feelings towards the delisting of the developer, which owns the third-largest residential land bank in Hong Kong. Some criticised the take-private offer as being too stingy.

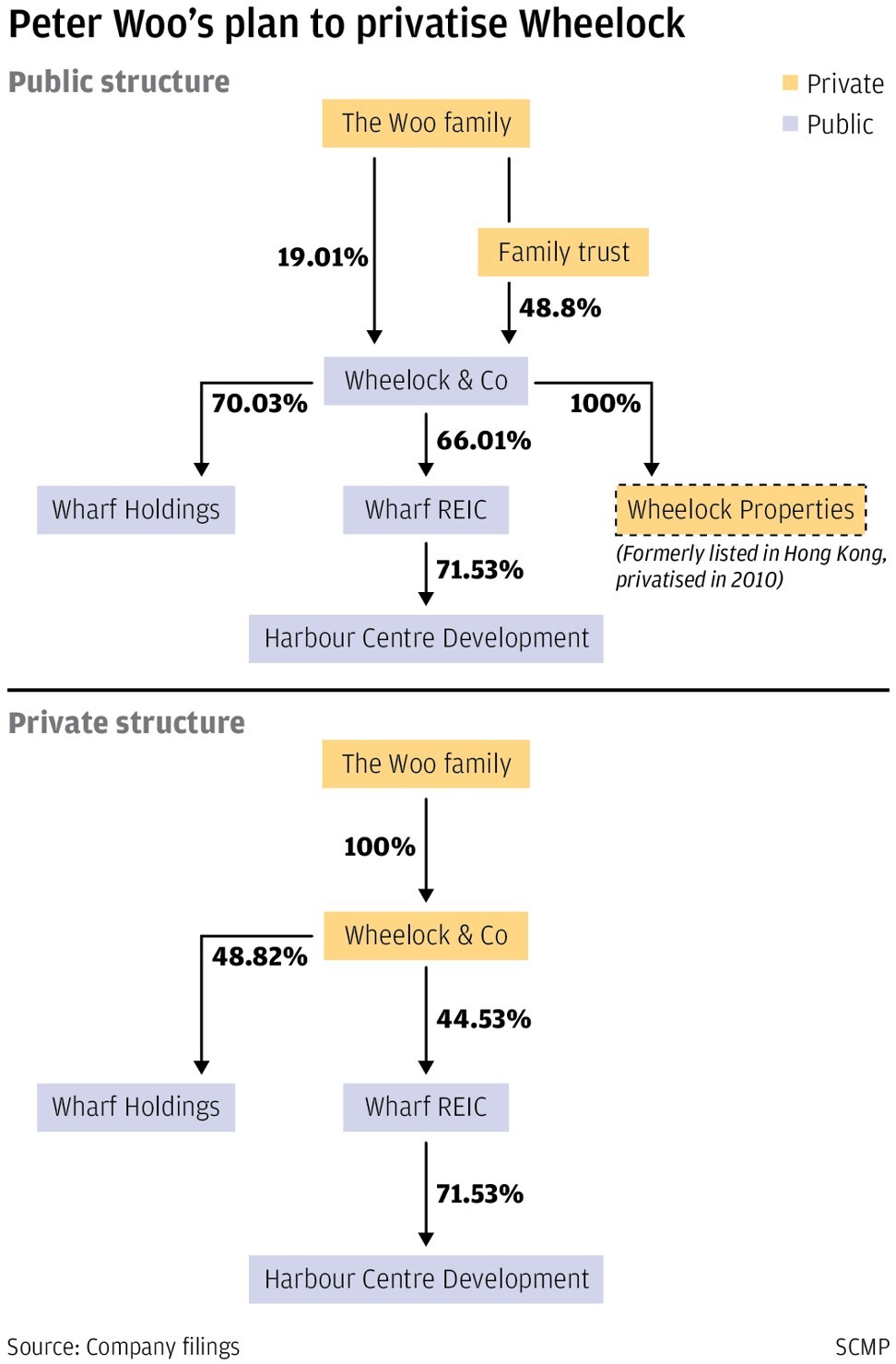

Wheelock’s investors would receive HK$12 in cash, plus one share each of Wharf Holding and Wharf Real Estate Investment (Reic) – two subsidiaries of Wheelock – for every share they own.

The offer has depreciated in value since February, however, as the share prices of Wharf Holding and Wharf Reic slumped by 20 per cent and 10 per cent respectively, under a gloomy outlook for Hong Kong’s retail property due to the Covid-19 pandemic.

“The big shareholder should have set the offer price higher,” said an 80-year-old shareholder, who has owned a stake in Wheelock for more than four decades and wishes only to be identified by his surname Chan. “I don’t want the company to be privatised just like that,” he said, adding that the value of the offer now is lower than when it was proposed.

Billionaire Peter Woo to take Wheelock private, handing HK$16.5 billion value windfall to shareholders

Some supporters are taking a more optimistic view, saying the offer is still attractive. Wharf Holding and Wharf Reic are both big companies with a long history, and they have weathered much turbulence in the past, said Danny Chan Chung-cheung, who owned the stock since late last year.

Like tycoon Li Kashing’s CK Hutchison empire, Wheelock traces its roots to one of the major British-established “hongs” of Hong Kong that dominated the city’s shipping and trade business in the early 20th century.

03:41

Fears of fresh Covid-19 outbreak in Hong Kong after 6 cases reported connected to a building

Founded in 1857 in Shanghai, Wheelock redirected its focus to Hong Kong under the leadership of British businessman George Ernest Marden after World War II broke out. The company was mainly involved in shipping, but also acquired businesses in retail – such as fashion retailer Lane Crawford – and property development.

Shipping magnate Pao Yue-kong took control of Wheelock in the 1980s after a fierce shareholding battle against Singaporean tycoon Khoo Teck Puat, when its then-controllers – the Marden family and the Cheung family – grew apart and decided to exit the Hong Kong market.

After Pao retired in 1986, Peter Woo, who married Pao’s daughter Bessie Pao Pui-yung after starting his career in banking in New York, took charge of the company and turned it into an avid bidder on land parcels in Hong Kong, while venturing into property development in mainland China.

Woo, who turns 74 in September, is ranked as Hong Kong’s eighth wealthiest person with a US$13.5 billion fortune, according to Forbes. He stepped down in 2015 and was appointed a senior counsel of the company, when Douglas Woo became Wheelock’s chairman.