New World Development sells Tsuen Wan shopping mall to rival Hong Kong developer Chinachem for US$510 million

- Move is part of NWD’s plan to reduce its gearing over the next three years year as high interest rates pressure financing costs

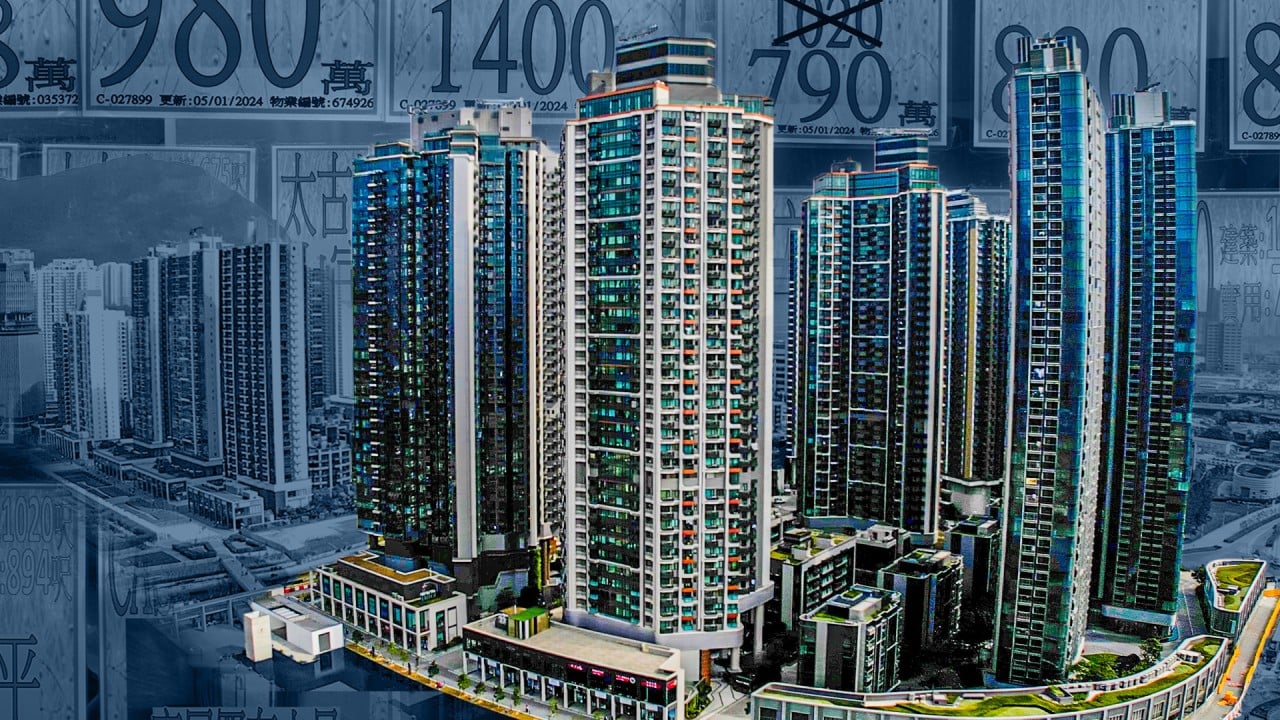

- The city developer is letting go of the retail portion of D-Park in Tsuen Wan, which has a total area of 630,000 square feet and 1,000 parking spaces

The shopping centre, built in 1997, is located about 10 minutes’ walk from the Tsuen Wan MTR station. NWD bought the other half-share in the project from its partner HKR International in 2010 for HK$1.37 billion and spent HK$700 million in 2012 to refurbish the property.

“We see NWD is operating in a very tough macro environment” due to the still elevated debt burden, Ken Yeung, an analyst at Citigroup, wrote in a report on February 29. “We believe this is not enough for offshore cash flow on expected weak Hong Kong property sales and continuous high offshore bond and interest payment.”

NWD’s shares fell 6.8 per cent to HK$9.20 on Friday, bringing the loss this week to 5.3 per cent. The Hang Seng Properties Index, which tracks 10 of the biggest developers on the bourse, declined 1.3 per cent for the week.

NWD to tap improved sentiment by bringing property launches forward

The developer is bringing forward some of its housing projects to the market by launching 2,500 flats in the coming six months, CEO Adrian Cheng said. The move is to meet an expected surge in demand, after Hong Kong scrapped many of its decade-old curbs on home purchases and financing earlier this week.

NWD expects to generate HK$2.63 billion of sales in Hong Kong and 9.8 billion yuan in mainland China from its projects in the second half of 2024, according to its latest interim report to shareholders.

Meanwhile, Chinachem said it was buying a premium regional shopping centre, which will create synergies with its other investments in Tsuen Wan. They include Nina Mall 1 and Nina Mall 2, Nina Hotel Tsuen Wan West, and Nina Park, according to the joint statement.