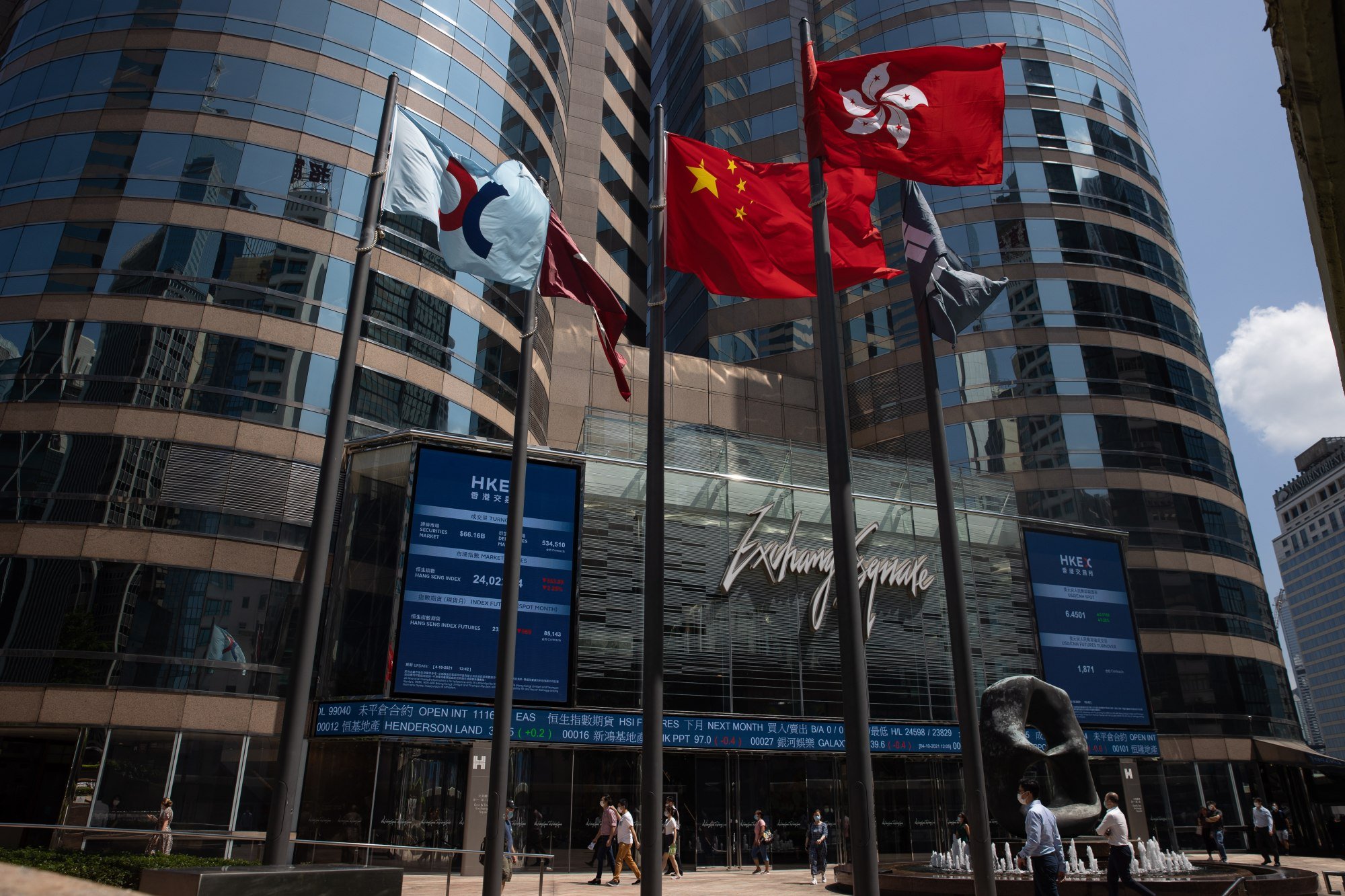

Hong Kong’s IPO market is looking up as pipeline grows, while mainland bourses to struggle amid regulatory curbs: Deloitte

- Hong Kong’s stock exchange could host 80 new listings in 2024 with estimated proceeds of HK$100 billion (US$12.8 billion), Deloitte China forecasts

- Some 155 listings in Shanghai, Shenzhen and Beijing are projected to generate as much as 166 billion yuan (US$22.9 billion) of proceeds in 2024: forecast

“We have witnessed an increase in listing applications, in particular from the artificial intelligence, life science and healthcare industries, which are important sectors,” said Edward Au, managing partner for the southern region at Deloitte China. Hong Kong remains a top choice of listing due to its global financial centre status and appealing market reforms, he added.

While many potential issuers are waiting for a rebound in market valuations, certain companies are committed to listing in Hong Kong based on their pressing fundraising needs to support their growth, he added after releasing the firm’s equity market outlook on Monday.

Hong Kong’s stock exchange could host 80 initial public offerings (IPOs) in 2024 with an estimated proceeds of HK$100 billion (US$12.8 billion), according to a forecast by Deloitte China. Stronger measures taken by Beijing to recharge the mainland economy and possible interest rate cuts in the US later this year, are supporting factors, it added.

The city made a sluggish start this year, with 12 IPOs generating HK$4.7 billion in proceeds, or a 30 per cent drop from a year earlier.

“The Hong Kong market started to show more positive signs in March with more new listings and better market turnover,” said Robert Lui, who leads Deloitte China’s offering services for the southern region. “Turnover and valuation, which depend on market liquidity, remained low, resulting in a slow performance [last quarter],” he added in the report.

HKEX eyes Saudi, Indonesian companies to win more IPOs from emerging markets

In China’s domestic market, A-share offerings could remain depressed, given ongoing geopolitical uncertainties, weak investor sentiment, and heightened regulatory scrutiny since the appointment of a new head at the China Securities Regulatory Commission.

Stock exchanges in mainland China managed 30 new listings in the first quarter, which generated 23.6 billion yuan (US$3.3 billion) of proceeds or a 64 per cent slide from a year earlier, Deloitte said in the report. The bourses in Shanghai, Shenzhen and Beijing are projected to generate as much as 166 billion yuan from 155 new listings in 2024, it forecasts.

The heightened scrutiny over new listings in the A-share market has resulted in a drop of both number and proceeds” raised across the five major listing boards in the three major cities last quarter, Deloitte said.

The Shanghai Stock Exchange, which raised 14.8 billion yuan last quarter, ranked among the top five busiest venues globally. Its performance was helped by several strong manufacturing and technology, media, and telecommunications companies, Deloitte said.