Mainland PMI data adds to weakness fears

Buying gauge hits lowest level since March 2009, fuelling job concerns as producers deal with dwindling orders at home and abroad

The mainland economy is showing further signs of slowing as manufacturers grapple with dwindling overseas and domestic orders, fuelling concerns of lay-offs by employers in the absence of a fresh stimulus package.

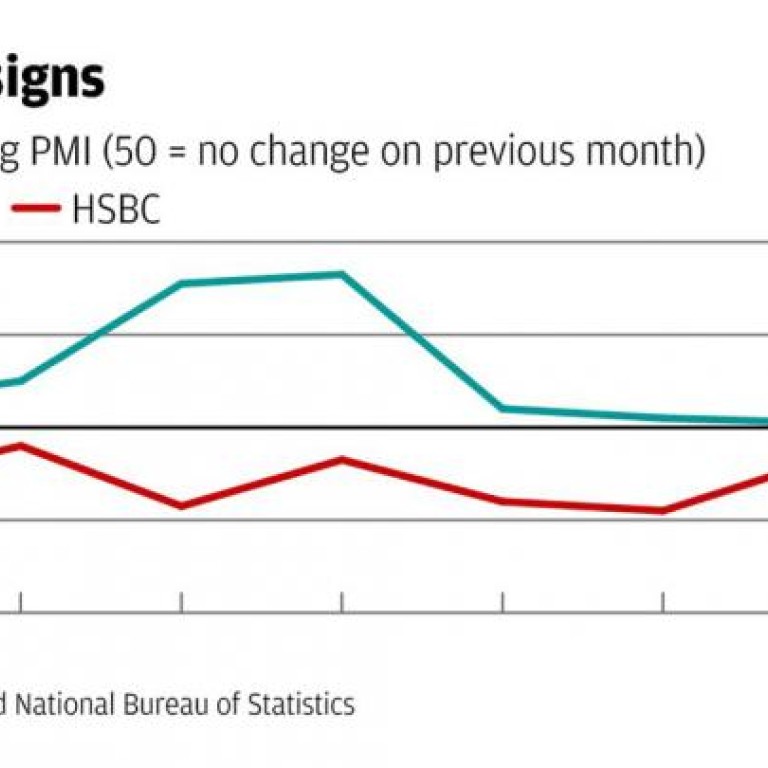

The purchasing managers' index released by HSBC and Markit Economics yesterday slumped to 47.6 in August from 49.3 in the previous month as the mainland's manufacturing activity hit the lowest level since March 2009.

The survey by the British banking giant and the specialist research company mirrored the official PMI published by the National Bureau of Statistics over the weekend, which showed the manufacturing activity index falling 0.9 point to 49.2 in August. It was the first time in nine months that the official PMI fell below the 50-point threshold.

A PMI reading above 50 indicates growth in manufacturing while a reading below 50 indicates contraction.

"The economy is sluggish based on the PMI data," said Shenyin Wanguo Securities' chief economist Li Huiyong. "Companies are under increasing pressure to survive the slowdown."

The poor PMI figures triggered mounting worries about lay-offs as mainland employers have struggled to keep their businesses afloat amid the slowdown.

The mainland economy expanded by 7.6 per cent in the second quarter, the slowest pace in three years, and the outlook is for the economy to keep slowing in the second half amid stronger global headwinds.

Despite growing calls for the central government to roll out fresh incentives to bolster the weak economy and support troubled businesses, analysts said it was unlikely that strong measures would be taken soon. Since the cabinet will undergo a major reshuffle in March next year, no major incentives are expected to be implemented by lame-duck Premier Wen Jiabao and his cabinet.

While the market widely expected Beijing to trigger a third cut in interest rates this year, Adrian Foster, head of financial markets research for Asia Pacific at Rabobank, said the central bank was most likely to take a go-slow approach.

"I don't think inflation or PMI are the mainland government's major concerns anymore, as long as property prices remained in check," Foster said. "There's still no urgent need for the central bank to cut rates, and it may reserve it as a last resort [to rescue the economy] in case the euro crisis gets worse."

Beijing set a 7.5 per cent economic growth target for this year, and risks are increasing that Wen's cabinet might not be able to meet the goal for the first time since he took office in 2003.

The mainland economy grew 7.8 per cent in the first half of this year, slightly higher than Beijing's expectations.