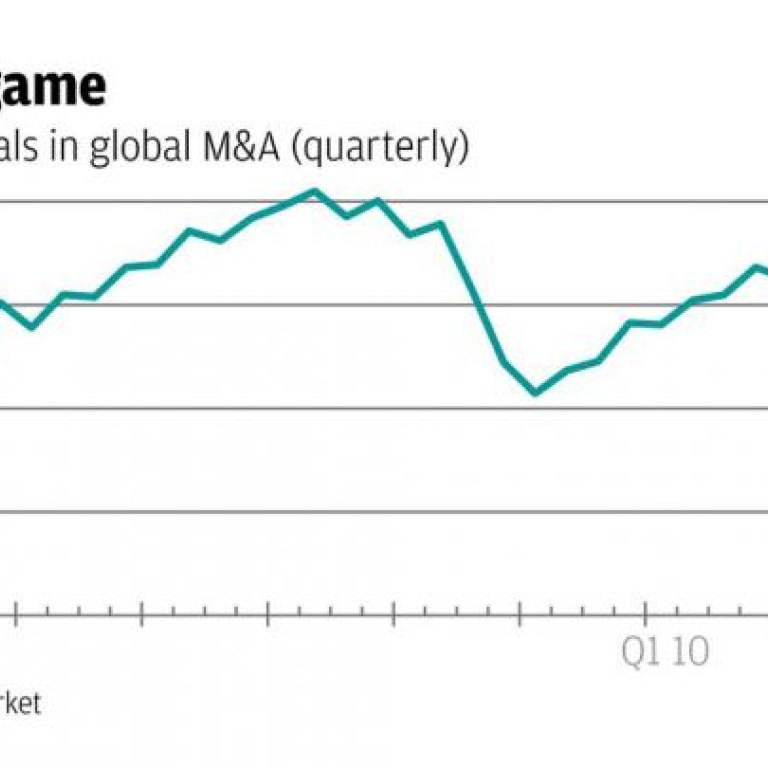

Global M&A activity dulls for the first three quarters

Global market experiences a dismal first nine months as euro-zone debt problems and other uncertainties weigh on would-be acquisitors

The global mergers and acquisitions (M&A) market has been dismal in the year's first nine months, battered by euro-zone debt problems and an uncertain recovery in major economies.

Firms have found it difficult to grow organically by expanding sales, since China's decelerating growth has cast a shadow over the global economic outlook.

However, despite record piles of cash on hand and inexpensive valuations of potential targets, corporate executives are taking a wait-and-see approach, market participants suggested, until the euro bloc begins to see a definitive resolution to its long-running economic and sovereign debt woes.

Discussing the reasons for the sharp drop in M&A activity, Mergermarket cited the wide bid-ask spread as one of the two major factors affecting the industry.

Market observers say this may be because of cautious sentiment that has taken "tail risks" - contingencies that could have significant consequences although their likelihood might be very small - in the euro zone into consideration.

The report also blamed "likelihood of completion" as another reason for the dull M&A market, without further explanation. This could refer to greater difficulty raising funds for deals or overcoming national objections to takeovers of sensitive targets.

In the third quarter, European M&A deals plunged 46.1 per cent from the second quarter to US$99.2 billion, a decline of 40 per cent from the same period last year.

Farhan Faruqui, Asia-Pacific head of corporate and investment banking at Citigroup, said in July that investors might wait for the euro zone's economic and debt troubles to stabilise but there could be several macroeconomic "trigger points that might suddenly push more deals to be struck".

The economic slowdown in China is also weighing on investors' confidence. The world's growth engine grew 7.6 per cent in the second quarter from a year earlier, the slowest pace since the first quarter of 2009.

Economists say softening Chinese demand has put pressure on countries that rely on exports ranging from consumer goods to commodities such as iron ore.

Australia's central bank cut its benchmark lending rate by 25 basis points to 3.25 per cent on Tuesday, suggesting the world's third-largest producer of minerals and metals is feeling the pain of weakening Chinese demand.