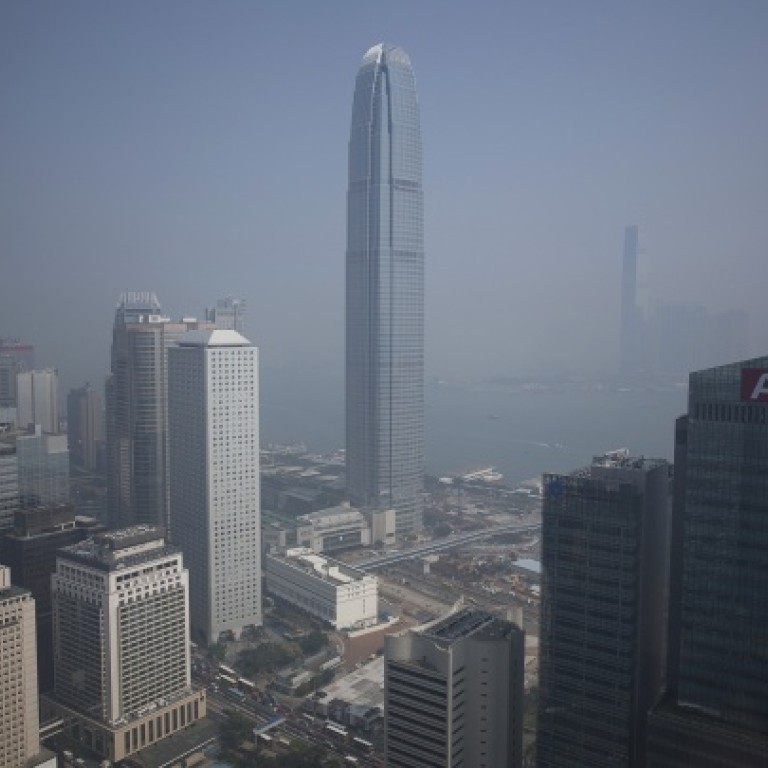

Economy at risk of overheating warns HKMA chief

HKMA boss warns rising levels of household debt and high consumer spending could see families left in a vulnerable financial position

Soaring household debt and rampant consumer spending have put Hong Kong's economy at risk of overheating, the city's central bank boss said yesterday.

In a briefing to the Legislative Council's financial affairs panel, he said the ratio of household debt to gross domestic product had risen to a record 61 per cent from 59 per cent at the end of last year.

The previous record was 60 per cent in 2002.

Household debt includes credit card loans, personal loans and home loans, which are usually a family's largest debt.

The higher the ratio, the more vulnerable people will be when interest rates go up.

Chan said the surge in property prices in recent years had fuelled an increase in Hongkongers' spending on consumer items. He was concerned that private consumption has grown faster than GDP since 2005.

And because much of the consumption is based on credit, "once the interest rate turns up, the macro economy will be at risk", Chan said.

He also pointed to a decline over a short period in the current account balance - essentially, exports of goods and services, plus other income minus imports - as another "warning signal" that the economy is at risk of overheating.

Hong Kong's current account balance plunged to 1.1 per cent of GDP at the end of last year from 15 per cent in 2008. Exports were stable during that period, but imports jumped.

Raymond Yeung Yue-ting, senior economist at ANZ Banking in Hong Kong, said when the rise in interest rates exceeded the rise in wages, people would be less able to pay their debts.

That could result in a surge in the number of homes in negative equity - properties worth less than their outstanding mortgage.

But he said a fall in the number of property transactions could ease the risk of the economy overheating.

HKMA deputy chief executive Arthur Yuen Kwok-hang said the authority would keep an eye on the risk management strategies of banks when handing out personal loans.

Such loans account for about 5 per cent of the total loan book of a bank, he said.

"It is too early to tell which way property will go, because the external environment, such as in Japan, the US and Europe, is quite uncertain. We have to monitor the situation closely," he said.