Figures point to growth faltering in China

Trade, inflation and new loans decline in May, raising pressure on Beijing to undertake measures to ensure more-sustainable growth

The mainland's trade, inflation and lending data for last month all showed a downward trend and trailed estimates, in more signs that weaker global and domestic demand will test the new leadership's resolve to forgo short-term stimulus for slower, more-sustainable growth.

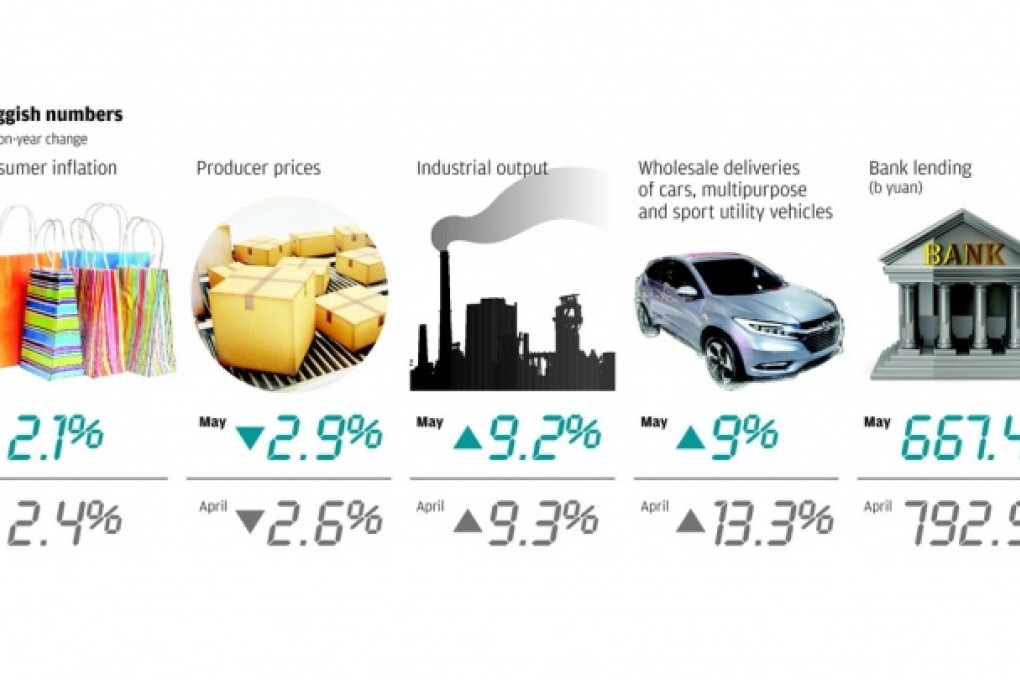

Industrial production rose a less-than-forecast 9.2 per cent from a year earlier and factory-gate prices fell for the 15th consecutive month, National Bureau of Statistics data showed. Export gains were at a 10-month low and imports fell after a crackdown on fake trade invoices while fixed-asset investment growth slowed and new loans declined.

Premier Li Keqiang told provincial leaders on Saturday that while growth was still relatively fast and within a reasonable range and employment was stable, "complicated factors" were ahead and must be closely monitored.

At his summit with US President Barack Obama, President Xi Jinping said "we have full confidence in sustained and healthy long-term economic development" and that risks and challenges were controllable.

The sluggish data, nonetheless, adds to pressure on them to boost the numbers.

Consumer inflation slowed to 2.1 per cent, the lowest in three months, while producer prices fell 2.9 per cent, the lowest since September last year.

"The inflation data showed China's economic growth continued to slow. First-quarter growth is probably even slower than the second quarter's. In particular, the [producer price index] data showed very weak demand," said Shen Jianguang, the chief China economist at Mizuho Securities Asia in Hong Kong.