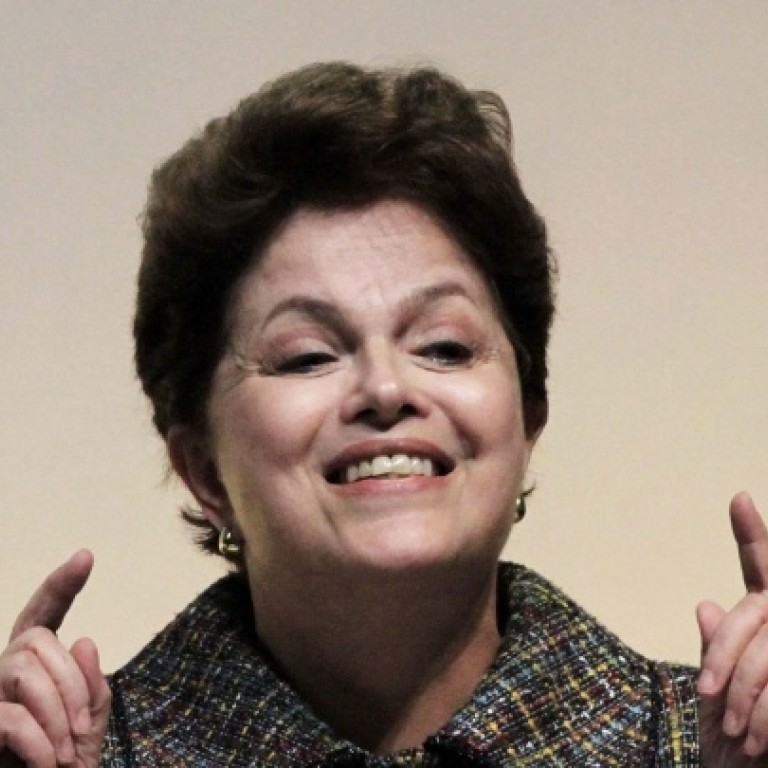

Brazil shifts course after Rousseff’s bet goes bad

The government of Brazil’s president, Dilma Rousseff, is changing tack after unorthodox policies did not work as planned.

President Dilma Rousseff’s big gamble for this year was that Brazil had matured enough for investors to accept permanently lower interest rates, looser fiscal policy, and lower returns on big infrastructure projects like new highways.

Six months in, it is clear she was wrong and, in typically pragmatic fashion, her government is rapidly shifting course to avert even bigger trouble.

Last week’s warning by ratings agency Standard & Poor’s of a possible downgrade on Brazilian government debt was only the latest example of the financial world lashing out against Rousseff’s interventionist economic management.

Brazil’s currency has tumbled nearly 8 per cent in the last two months while the Bovespa stock index has lost over 13 per cent this year - both among the worst performances by emerging-market assets anywhere.

A trained economist who relishes making even the smallest policy decisions herself, Rousseff took office on New Year’s Day in 2011, inheriting an economy that was widely admired by foreign investors but was also overheating after a 7.5 per cent expansion the year before.

When growth slowed to a crawl during the next two years, Rousseff tied much of the blame to the “tripod” of economic policies that had marked the past decade: a floating currency, a fixed budget surplus target and a rigorous inflation-targeting regime that in practice meant double-digit interest rates.

Those policies had helped Brazil regain investors’ confidence after hyperinflation in the 1980s and early 1990s. But they also made credit expensive and severely restricted the government’s ability to stimulate the economy through tax cuts and fiscal spending during times of slow growth.

So Rousseff and her top economic officials, believing Brazil had earned some leeway, decided to force the issue.

In the final months of last year, the central bank cut its benchmark Selic rate to a record low of 7.25 per cent, completing an easing cycle of 5.25 percentage points. Also, the government effectively loosened the surplus target, and announced that future infrastructure projects would offer lower returns - in line with a new, less risky Brazil.

None of it worked out.

Prices rose 6.5 per cent in the 12 months through May, according to data released Friday, putting inflation at the ceiling of the central bank’s tolerance range.

Meanwhile, the changes ended up adding to Rousseff’s reputation in some sectors as a heavy-handed meddler who seeks to impose her will on the private sector - making investors nervous about what she might do next.

S&P cited “weaker fiscal and external fundamentals, and some loss in the credibility of economic policy” when it revised its outlook on long-term ratings for Brazilian sovereign debt to “negative,” indicating a one-in-three chance of a downgrade.

The potential reward for Rousseff’s big risk - higher growth - hasn’t panned out either. Gross domestic product grew just 1.9 per cent on an annual basis in the first quarter, according to data released last week.

The good news is that Rousseff, who was a leftist guerrilla in the 1970s, has consistently shown a pragmatic side - and the willingness to change tack quickly when policies don’t work.

Especially in the last 10 days since the GDP data release, many analysts have noticed a significant shift.

The central bank surprised markets last week by raising the Selic 50 basis points to 8 per cent, despite the weak economy. Thursday’s statement explaining the decision was hawkish, prompting some to bet the Selic could soon rise to near the double-digit threshold Rousseff swore was a thing of the past.

In a report entitled “Brazil: Wake up and smell the coffee,” investment bank BNP Paribas congratulated the government for sounding “much more realistic” about inflation risks.

“Psychologists agree that moving from denial to acceptance is an important step in the healing process,” the report said.

On Wednesday, the government suddenly dropped an unpopular tax on foreign investments in local debt. It had been designed to keep the currency from strengthening, but in practice infuriated many investors and also violated another cherished element of the “tripod.”

Rousseff has also backtracked on the concessions issue, announcing last month that returns for private investors who help with railroads and highway projects would be significantly higher than first diclosed.

There have also been hints of change on deeper issues holding Brazil back, such as its relatively closed domestic market. US officials were positively surprised by Rousseff’s openness to possibly greater trade integration when US Vice President Joe Biden visited Brasilia last Friday.

The biggest doubt going forward is whether Rousseff will also rein in the fiscal spending that has alarmed S&P and others. Gross debt, which measures not only federal government debt but other liabilities such as state-run banks, has jumped from about 53 per cent to 59 per cent during her administration.

Many investors are urging her to re-embrace the rigid fiscal target that served the country well for so long.

S&P’s decision “is a warning sign that the government that heterodox economic policy didn’t work out, and that the government needs to go back to adopting orthodox measures to re-establish its credibility with the market,” said Luciano Rostagno, chief strategist for WestLB Brasil in Sao Paulo.