Inflation or deflation? It's all as clear as mud

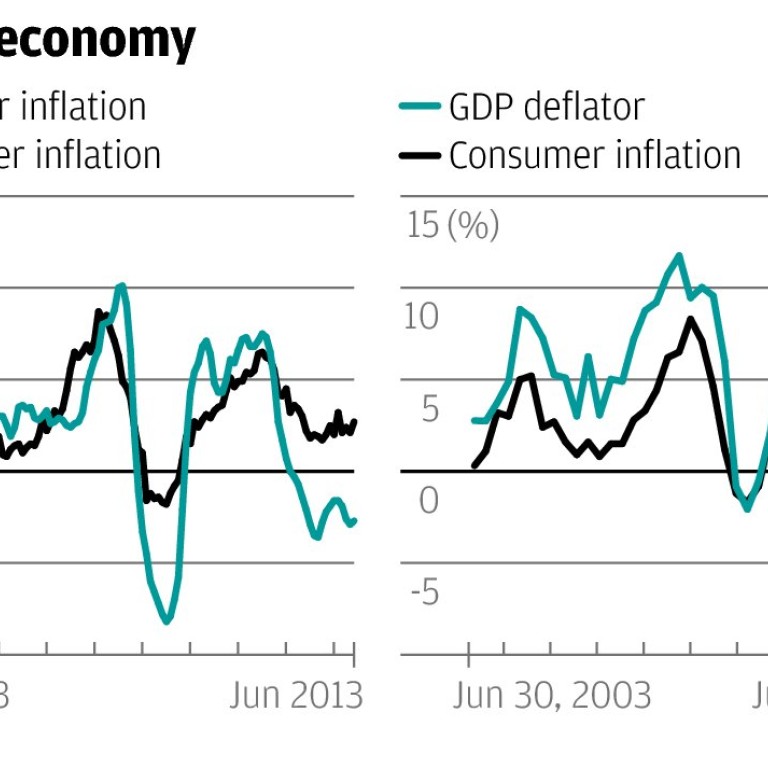

China's economy-wide inflation has been mostly above consumer inflation; over the last year, however, the position has reversed

Monday's edition of the carried an opinion article by Yu Yongding, in which the former People's Bank of China adviser wrote that the risk of inflation was constraining China's economic growth.

In a nutshell, Yu argued that economic circumstances have changed: workers are no longer as plentiful and as cheap as a few years ago, while China has already reaped all the gains it is likely to get from simple technology transfers from the developed world.

That means labour costs are going up, while productivity gains are more difficult to come by. As a result, China's economy can no longer grow as quickly as before without fuelling runaway inflation.

Now Yu is a very smart chap, and all his arguments sound eminently sensible - except for one thing: over the last couple of years, China's inflation rate has plunged, and the economy now appears to be in danger of sliding into deflation.

Granted, this threat isn't immediately obvious from the consumer inflation figures.

In June, consumer price inflation was running at 2.7 per cent, up from 2.1 per cent in May. And when the numbers for July are released on Friday, most private sector analysts expect the rate to tick up further.

Economists at Goldman Sachs, for example, believe consumer inflation climbed to 2.9 per cent in July, propelled by a rise in food prices following recent bad weather.

No doubt they are close. But it is misleading to look at consumer prices as the main indicator of inflation in China, considering that consumer demand makes up only 36 per cent of gross domestic product.

Some analysts prefer to look at the producer price index, which measures the price of goods entering factory gates, as a more reliable gauge of inflation in the rest of the economy, which is powered mostly by investment. This tells an entirely different story. As the first chart shows, while consumer prices have continued to rise, producer price inflation rate has plunged, with prices actually in deflation since early 2012.

Bearish analysts interpret falling producer prices as a sign that excessive investment has resulted in vast industrial overcapacity, which is weighing on prices and threatens to push China into deflation. Unfortunately, there are problems with the producer price measure, too. Notably, it takes no account of China's expanding service sector.

To get a better idea of economy-wide inflation, you need to look at China's GDP deflator.

This is the inflation rate implied by the difference between China's real, or inflation-adjusted, growth rate and the nominal unadjusted growth rate of the economy measured in simple yuan.

Here we see evidence that although China isn't actually in deflation, it is undergoing disinflation.

As the second chart shows, for most of the last 10 years economy-wide inflation was running significantly above consumer inflation.

Over the last year, however, the position has reversed, with the implied GDP deflator falling to just 0.5 per cent in the second quarter of this year, down from a rate of 8 per cent two years ago.

This is a pronounced fall, which would appear to bear out stories of industrial overinvestment, as would recent directives from Beijing ordering the closure of excess capacity in industries including steel, glass, aluminium and ship-building.

Alas, there are difficulties with the GDP deflator as well. In the past, officials have manipulated the deflator to come up with an acceptable number for real GDP.

Now, some analysts suspect Beijing may be understating economy-wide inflation to boost real GDP growth figures. In other words, inflation may be higher than the data indicate, and economic growth lower.

That would seem to support Yu's argument that China can no longer enjoy growth with low inflation. It's all as clear as mud.