Fears grow over soaring Chinese debt

Local government debts have doubled over the past 3 years, a report estimates, putting into focus potential damage to economic growth

Concerns about rising leverage on the mainland have been heightened by a report last week which estimated that the liabilities of local governments may have doubled to 20 trillion yuan (HK$25 trillion) since 2010 as they sought to prop up economic growth.

In order to monitor the opaque finances of local governments and keep default risk under control, the National Audit Office began a nationwide probe at the beginning of last month. The results, to be released soon, will be keenly watched to discern the financial health of the world's second-largest economy after a lending binge over the past few years.

Fitch Ratings said last week that conservative estimates put the mainland's credit to gross domestic product ratio at the end of 2017 at close to 250 per cent, compared with 130 per cent in 2008.

"No financial system can sustain rising leverage indefinitely. Eventually, swelling debt burdens will constrain economic activity as greater resources are directed into debt-servicing and further investment exacerbates overcapacity," Fitch analysts said in a report on Wednesday.

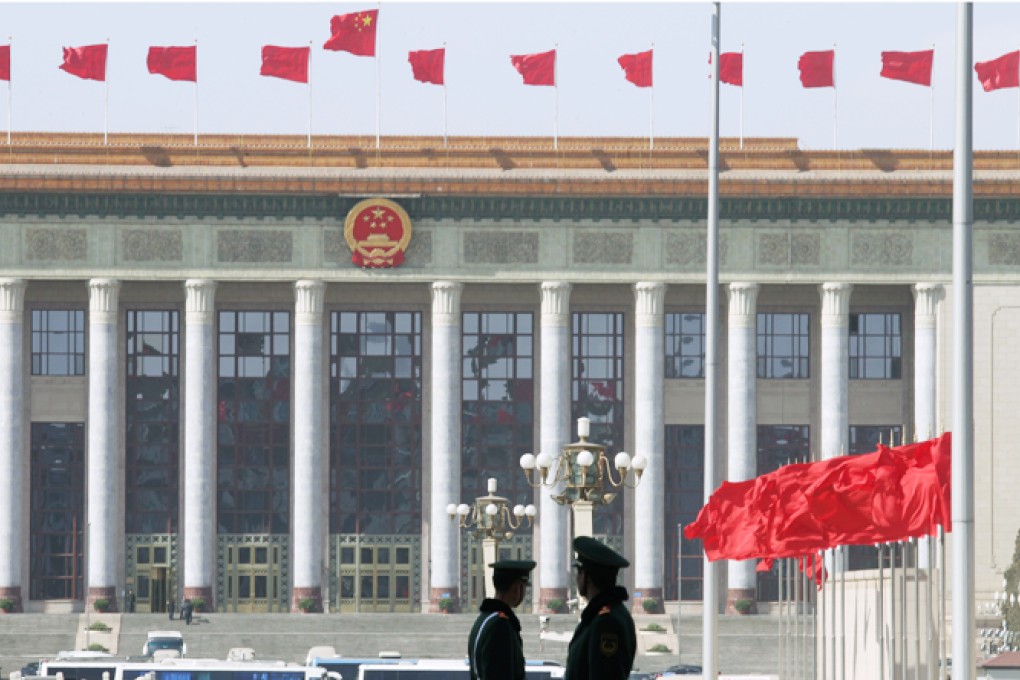

Chinese regulators will categorise local debts after the auditor's probe and tackle problems accordingly, according to Wu Xiaoling, a former central bank vice-governor and currently vice-chairwoman of the financial committee of the National People's Congress.

Most defaults were caused by a mismatch of short-term debt with projects that would generate cash flow in the longer term, Wu said, and the mainland would invite private capital to restructure the debts.