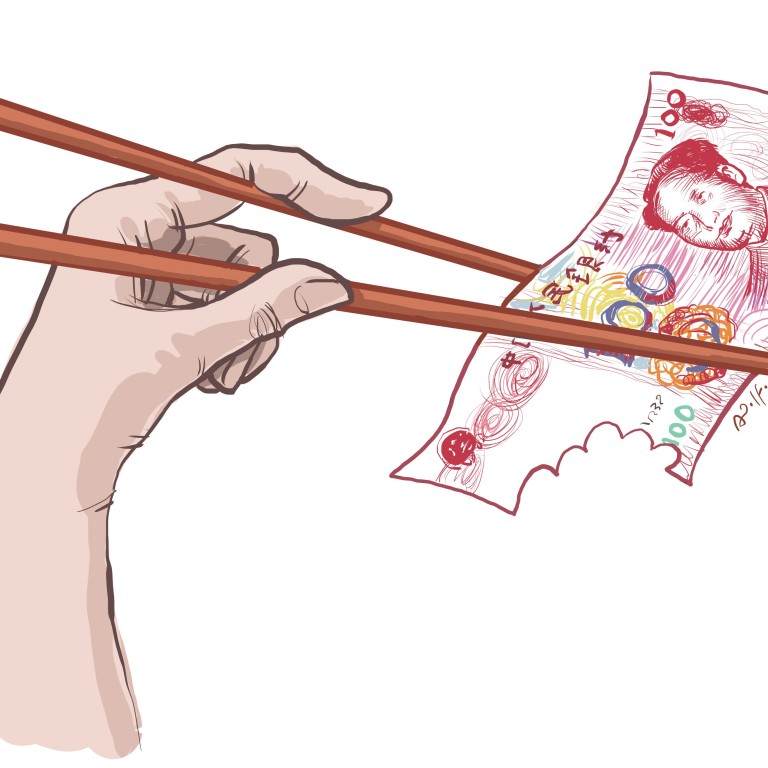

Consumption part of China GDP 'underestimated' amid gift giving

Mainlanders may be consuming more than the official figures reveal as firms pass off undeclared gifts to staff as business costs

The mainland's famously frugal households may be living larger than they are letting on.

Some economists, though, say official statistics have it wrong. To avoid taxes, consumers routinely get employers to buy stuff for them. That means the country has underestimated how much consumers spend and has exaggerated the lopsided nature of China's US$9.4 trillion economy.

The implications of their research are far-reaching, at least statistically. If two economists are right, not only do consumers represent a larger part of the mainland's economy than thought, but estimates of its household savings rates may be inflated, investment's dominance may be overstated and China's economy may be larger than current estimates.

China’s consumption is not low. It’s actually desirable

"China's consumption is not low," says Zhu Tian, an economist at the China Europe International Business School in Shanghai who co-authored a recent report on the subject. "It's actually desirable."

Government estimates put household spending at roughly 36 per cent of GDP, a long drop from 49 per cent in 1978. Household consumption in Thailand, which is slightly poorer than China in terms of GDP per citizen, is 56 per cent of GDP, according to the World Bank. In the United States, households spend the equivalent of 69 per cent of GDP.

Zhu and other economists say government estimates routinely overlook trillions of yuan in hidden household spending, particularly among the mainland's increasingly affluent middle class. To compensate for lower wages, companies in the mainland routinely lavish employees with gifts ranging from mobile phones and household appliances to luxury cars and vacations.

By taking some pay in undeclared perks, employees lower their taxable income and companies reduce their taxable profits.

While the items are for personal use, once a company pays for them the expense is classified as a business cost and left out of consumption and GDP.

Add those numbers, and household spending amounts to about half of GDP, more than 60 per cent when combined with government spending, according to Zhu's study, which was published in September with Zhang Jun from Fudan University's China Centre for Economic Studies.

The government may also be due a lot of income tax.

Beijing's National Bureau of Statistics declined to comment, though it has in the past conceded it may be underestimating consumption. It plans to revise the way it calculates GDP as early as this year.

Zhu and Zhang go even further, saying that their findings challenge the notion that consumption is inadequate, a problem analysts and policymakers, including the World Bank, have blamed on inadequate social safety nets such as unemployment and health insurance.

Collecting data on consumption is challenging in any developing country because so many of the things people buy are informal services not captured by tax authorities: foot massages, karaoke sessions, food from street vendors.

The mainland's statistics have drawn knocks from economists, who have resorted to a host of exotic alternatives, from consumption of salt to sales of imported Audis, to gauge the true health of the second-largest economy.

One problem is sample size: the mainland's statisticians base their estimates of household spending of 1.35 billion people, or 402 million households, on surveys of just 100,000 households.

Then there is the way they add up expenditure. Take housing costs, for example. Beijing tallies data on how much households pay in rent but uses outdated values to calculate the value of housing to homeowners.

Even at 50 per cent of GDP, the mainland still needs to get households to consume more domestic services if it wants to create a viable and growing middle class, says Kevin Lai, an economist at Daiwa Securities in Hong Kong.

"You can forever keep investing in new capacity, but where is the demand?" Lai says.

Zhu says that the mainland's consumption levels are already healthy; it is Beijing's emphasis on boosting consumption that needs re-examination.

"The focus of change," he says, "should be on improving equity and the efficiency of investment, not stimulating consumption."