Jake's View | Singaporeans not as wealthy as GDP figures suggest

HK performs better than the Lion City on the basis of personal consumption expenditure

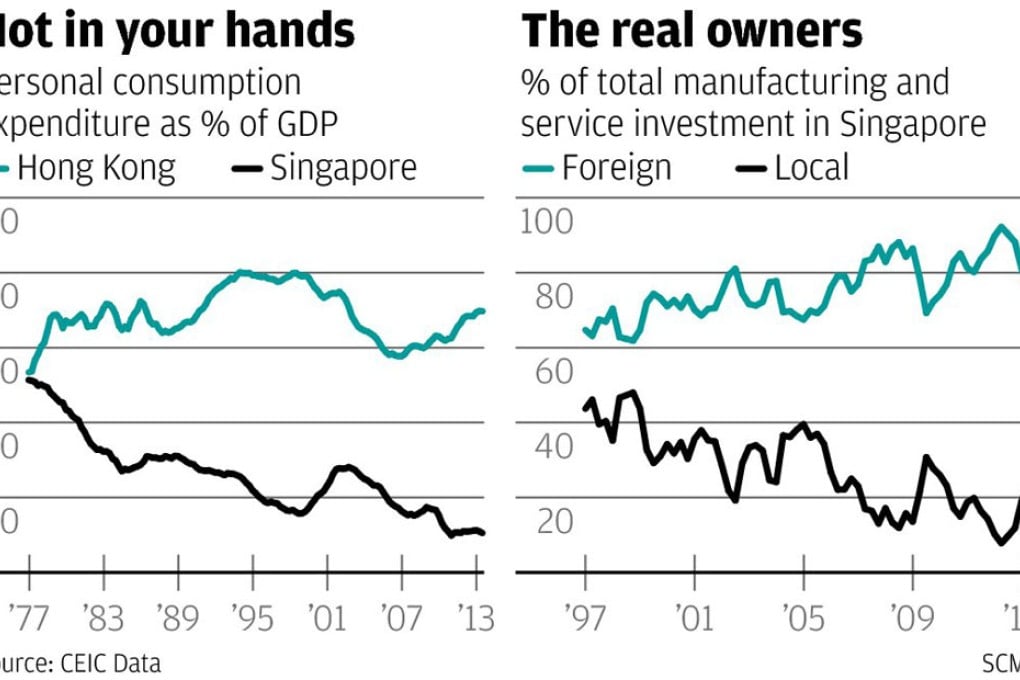

... the average growth of Singapore's gross domestic product and GDP per capita has outperformed Hong Kong's over the last 45 years. Its GDP was only half that of Hong Kong more than 20 years ago. Today the Lion City's GDP is slightly ahead and GDP per capita is 25 per cent higher than in Hong Kong.

OK, let's play games with GDP numbers as these are what Singapore bureaucrats love to play and as the numbers are not quite what they seem.

We shall start by conceding the headline figures. Yes, as of the latest statistical releases, GDP at prevailing rates of exchange runs at an annual rate of about US$52,000 per person of the total population in Singapore and US$37,000 in Hong Kong, which puts Singapore about 40 per cent ahead, not just 25 per cent.

The point about GDP, however, is that it is meant to be a measure of wealth. It does not mean much to you unless it represents wealth that finds its way into your hands, that is, unless it takes the form of a component of GDP called personal consumption expenditure.