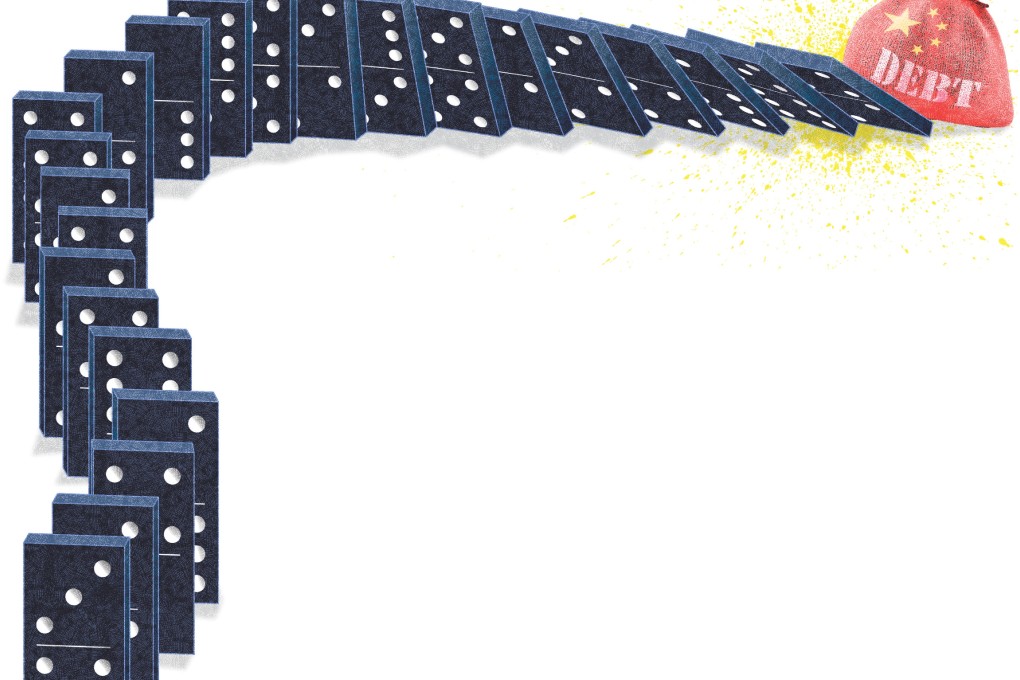

The View | China’s debt dominoes could fall fast

Mainland debt points to crisis as profligacy of local governments sees public borrowing hit US$3 trillion

The game of dominoes was invented in mainland China in the 13th century and was brought by Italian merchants to Europe, where it became a great hit.

And that is precisely what happens when debt goes wrong.

We know from public, private and anecdotal sources that public debt levels on the mainland are very high. The big debts lie with local governments - there is a combined public debt of US$3 trillion, according to official data released at the start of this year.

Local governments borrowed heavily to build large public-sector infrastructure projects, only some of which were useful.

But in a roughly US$9.4 trillion economy, the question is whether debt at that level really poses a problem.