Hong Kong ideal to host infrastructure bank, says JP Morgan chief

JP Morgan's Fang Fang says the city is perfect for the head office of an Asian infrastructure bank the Chinese president is keen to launch

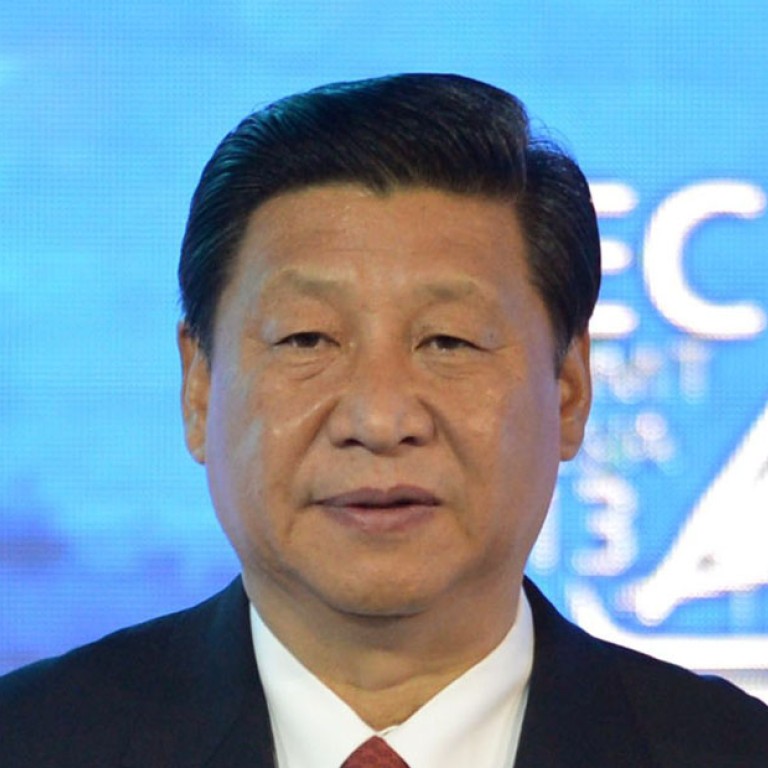

The Hong Kong government should grab the opportunity to make the city the home for the new Asian infrastructure investment bank proposed by President Xi Jinping during his trip to Southeast Asia last week, says a top banker and influential political adviser to Beijing.

Xi made the surprise proposal at his meeting with Indonesian President Dr Susilo Bambang Yudhoyono on October 2, saying Asia should have an infrastructure-dedicated bank to "promote interconnectivity and economic integration in the region".

He also said Beijing would be happy to take the lead in offering financial support to establish such a new regional bank.

China has more than US$3 trillion in foreign exchange reserves, the world's largest, and it is the No 1 holder of United States government debt, although Beijing is keen to reduce the size of its foreign reserves by diversifying its investments worldwide.

Xi did not say where he thought the new bank should be headquartered. However, political and economic analysts were quick to name Singapore, Kuala Lumpur in Malaysia, Beijing and Shanghai as possible candidates.

Fang Fang, chief executive of investment banking for JP Morgan in China, told the Hong Kong would be the best location.

He said the city is already an established financial centre where major financial institutions already gather and a hub for global deal-makers and fundraisers. The bank, he said, could be a platform for capital-raising for infrastructure investments and play a deal-making role to drive investments and Hong Kong was ideal to fulfil these roles.

Fang said the Hong Kong government should grab the opportunity in order to benefit the city's economic growth.

"It could be the first multilateral government-sponsored financial institution to be based in Hong Kong, and it would reinforce Hong Kong as a global financial centre," said Fang, who is a member of the Chinese People's Political Consultative Conference, the country's top political advisory body.

"It would make Hong Kong better integrated with the other Asian countries, particularly the Asean countries - which would provide the city with more business opportunities," said Fang. "It would boost other service sectors in Hong Kong as well."

China is already the largest trading partner of the Association of Southeast Asian Nations. Asean's member states include the major economic powers in the region, such as Singapore, Malaysia, Thailand and Indonesia. Xi attended the Asia-Pacific Economic Co-operation (Apec) forum earlier this week after state visits to Indonesia and Malaysia.

Xi's bank proposal is a conceptual plan that was discussed internally for at least a year but was originally scheduled to be announced next year, when Beijing hosted Apec's annual forum.