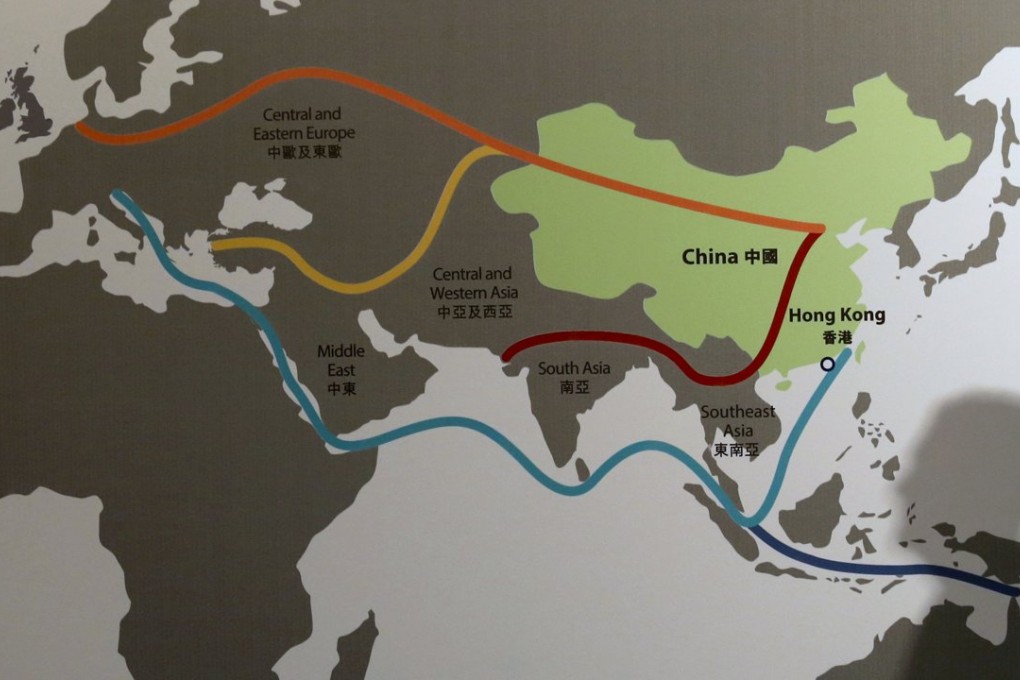

Hong Kong banking on a big role in financing China’s One Belt, One Road plan linking Asia to Europe and the Middle East

Hong Kong’s biggest banks and private equity players are moving fast to position their strategies to capture infrastructure financing opportunities that will emerge under China’s ‘Belt and Road’ initiative that is estimated to create a US$8.5 trillion market in the coming decade.

“Hong Kong will have an important role to play – not just as an intermediary,” said Laura Cha, chairwoman of the Financial Services Development Council, which expects the initiative to generate US$780 billion of transactions a year.

Hong Kong is already the largest foreign direct investment provider for China. Because of its other roles as a centre for equity finance, offshore yuan, risk management and trade settlement, the city aspires to play a “super-connector” role in the “Belt and Road” region that covers two-fifths of the world’s land mass and is host to some 60 per cent of the world’s population.

READ MORE: What is the One Belt, One Road strategy all about?

Addressing the ongoing Asian Financial Forum, Yue Yi, vice-chairman and chief executive of Bank of China (Hong Kong), said the bank is already lining up some 50 branches across the region with an initial lending target to generate US$20 billion worth of business. Over the past year, BOCHK has undertaken a wave of mergers and acquisitions with the aim of transforming itself from a Hong Kong local bank to becoming an “ASEAN regional bank”.

Echoing Yue, Benjamin Hung, regional chief executive for Greater China and North Asia at Standard Chartered Bank (Hong Kong), said StanChart’s branch presence along the Belt and Road zone is already in line to supplement the financing needs. “The Belt and Road strategy is going to have impact of epic proportion,” he said.

Gordon French, group general manager and head of global banking and markets at HSBC, estimates China will initially provide some US$240 billion to kick-start the project. If Hong Kong could recycle capital from the savings glut in Hong Kong, China and along the Belt and Road region for the rest, it could be “watershed”.

“If it is going to be done, it will be in Hong Kong,” French said.

The transactions cannot all be financed by bilateral loans alone and much of it would have to come from the equity and debt capital markets, he said, adding there is a now an extremely strong bond market in Hong Kong for global companies to tap.