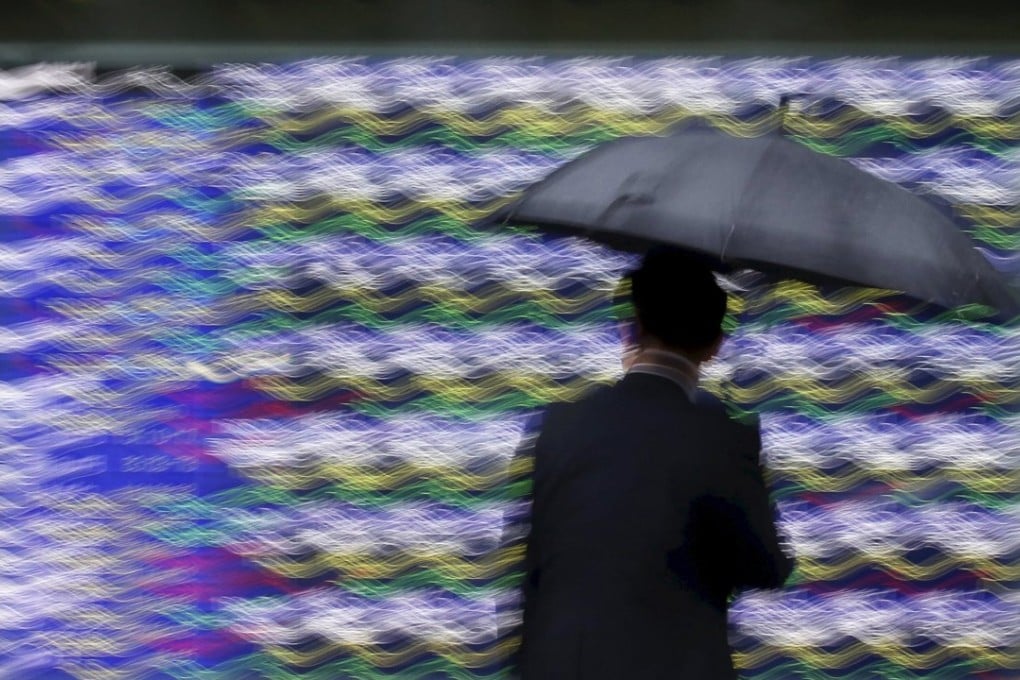

Macroscope | Japan’s Abenomics programme lies in tatters

A sharp spike in the value of the yen against the US dollar has undermined efforts to reflate

For an indication of the extent to which the limits of ultra-loose monetary policy have been reached, look no further than Japan.

On Monday, the publication of GDP data for the final quarter of last year showed that Japan’s economy shrank at an annualised rate of 1.4 per cent, an even sharper contraction than the one anticipated by analysts. That this was mostly due to a steep fall in private consumption - a crucial gauge of the success of premier Shinzo Abe’s reflationary economic programme, dubbed “Abenomics” - is a double whammy.

More than three years of aggressive monetary easing - the so-called “first arrow” of Abenomics and the boldest element in a three-pronged strategy which also includes fiscal stimulus and supply-side reforms - has left the Bank of Japan (BoJ) and Abe’s government with little to show for.

In January 2013, just months before the BoJ launched its first round of large-scale asset purchases, the central bank and Abe’s cabinet signed a joint statement pledging to haul the world’s third-largest economy out of a protracted period of entrenched deflation.

While corporate profits have surged as a result of the 40 per cent decline in the value of the yen against the dollar since the end of 2012, and domestic demand has at least been growing of late, the economy only managed to expand 0.4 per cent last year, following no growth at all in 2014.