Why AIIB is bigger but no better than ADB

Hong Kong may join Beijing-led AIIB by year end.

SCMP headline, March 26

I once went to an annual general meeting of the Asian Development Bank, and there received object lessons in the arts of how to waste money and how to abase myself in the presence of the lords of creation.

These particular lords of creation were the deputy finance ministers of various Asian countries, each of whom had installed himself in a suite at the Philippine Plaza hotel in Manila, where the event was being held.

As No 3 on a three-man delegation from an American investment bank, I was there to make our presence seem all the more a gesture of respect for the big man while our No 1 in roundabout ways asked him, “please, Sir, may we handle your next big bond issue or any privatisation you care to arrange”.

The Big Man would then deign to bestow us with the light of a smile from his countenance and tell us he would consider the matter. We would thereupon stay for another five minutes during which it was my task to laugh at his witticisms and nod solemnly at the profundity of his wisdom.

Along the way I figured out how the ADB worked. Japan ran it and the game was to lend yen on low Japanese interest rates to government-sponsored agricultural support projects for the purchase of Japanese pumps, ditch-diggers and other such equipment.

The catch was that the governments of the countries borrowing the money must guarantee the loans.

The result was financial disaster. The yen went way up and there was no way that destitute Indonesian and Thai farmers could ever repay. Everyone at the hugely overstaffed ADB palace in Manila then cried crocodile tears and the Indonesian and Thai fiscal deficits grew larger.

In 1941 they called this sort of thing the Greater East Asia Co-Prosperity Sphere. The results were not much less devastating in its second appearance.

Japan has since withered in relative importance and another great power has risen to take its place in Asia. The authority structure of the ADB, however, has not been amended to reflect this change. How fitting then that China should set up its own and bigger version, the Asian Infrastructure Investment Bank.

How fitting in particular as the United States and Japan, annoyed with China’s claims to rocks in the Sea of Vietnam, have teamed up to exclude China from their own trade and investment arrangements in Asia.

Beijing has done them one better. It has signed up half of Europe as starting partners of the AIIB. Take that, Obama. Suck it up, Abe. If you want to join now, you’re juniors or you don’t get in.

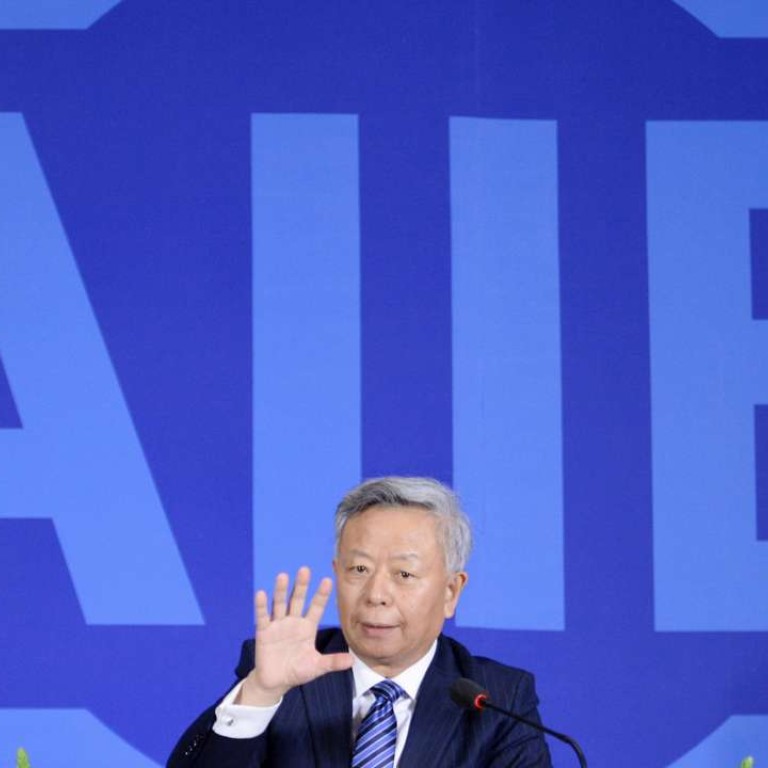

Thus when this new bank’s president, Jin Liqun, according to our report “dispelled rumours that the setting up of the AIIB reflected Beijing’s ambitions to challenge the present global financial governance regime”, I begin to wonder about the many meanings of the word “dispel”.

Deny them, yes. Anyone can deny. But he cannot refute or dispel them. They are not rumours. They are fact.

It is also fact that while government-sponsored development banks may have had some role to play in Asia in the 1950s, when other financial arrangements were primitive, things are so no longer.

Any worthwhile infrastructure project will have commercial banks from around the world falling over each other to take part. There is no shortage of money. There is only ever a shortage of good ideas for the use of it.

This in turn means that the bad ideas in infrastructure will go the AIIB and the ADB, which do not really care as they are driven by political jealousies rather than any real consideration for what is and what is not worthwhile in infrastructure.

We have now been told that Hong Kong may be allowed to join the AIIB soon as a sub-sovereign member.

Let us all applaud fulsomely and tell the AIIB that we are happy to see it raise as much money as it can on our financial markets and we warmly welcome any conferences it may choose to host in Hong Kong. Please, sirs, set up a regional office here.

But keep your hands off our fiscal reserves.