Jake's View | Singapore’s pension fund is not a model for Hong Kong to follow

When the boss takes investment decisions out of the hands of the citizens, you just get poorer citizens

Hong Kong should follow Singapore’s model in allowing employees to use part of their provident fund savings to buy their first property, according to the regulator of the city’s pension fund.

SCMP, June 10

Here we go again. We have to do it because Singapore does it. Let me offer a contrary thought to this seemingly irrefutable reasoning. Singapore does a lot of fool things. Let’s be glad we’re not Singapore.

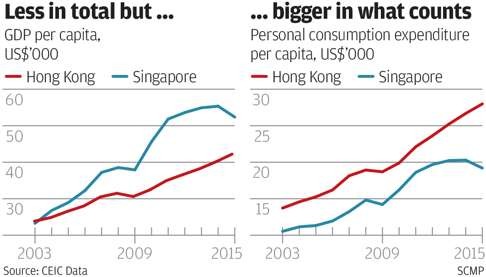

The two charts below make one essential difference clear. The first shows you gross domestic product per capita in US dollar terms. Singapore’s is clearly the greater, arguably because of a strong currency throughout most of the period, but greater nonetheless.

The second chart shows you the difference in personal consumption expenditure per capita, which is you and your disposable income, and here Hong Kong comes up as almost 50 per cent greater than Singapore. We have 66 per cent of our GDP available for personal consumption. The equivalent figure in Singapore is only 36 per cent.