Hong Kong keeps S&P’s top ‘AAA’ rating despite Moody’s cut

Rating reflects the views there are still traditions that are distinct to Hong Kong and not mainland China, according to S&P Global Ratings

Hong Kong’s economy has become more integrated with China’s over the past 20 years since the handover – but the city continues to be higher rated, at “AAA”, reflecting the views there are still traditions that are distinct to it and not mainland China, according to S&P Global Ratings.

Its top rating is in contrast with Moody’s which downgraded Hong Kong by one notch to Aa2 last month after it cut China’s sovereign credit to A1 from Aa3 reflecting prediction that domestic debt is expected increase further in the coming years. Fitch, meanwhile, rates China at A-plus.

Moody’s had said Hong Kong could face bigger financial risks and see its credit ratings drop further with its growing involvement in China’s plan to open up trade along a new ancient silk trading routes, the country’s “Belt and Road Initiative”.

But the special administrative region’s (SAR) exceptional degree of autonomy in many policy areas is a key reason why its credit ratings remain stronger, according to S&P.

“Hong Kong’s policy autonomy and strong financial resources are expected to insulate the territory against negative credit developments in the rest of the country to a larger extent than other Chinese sub-national governments,” said S&P analysts Kim Eng Tan and Christopher Lee.

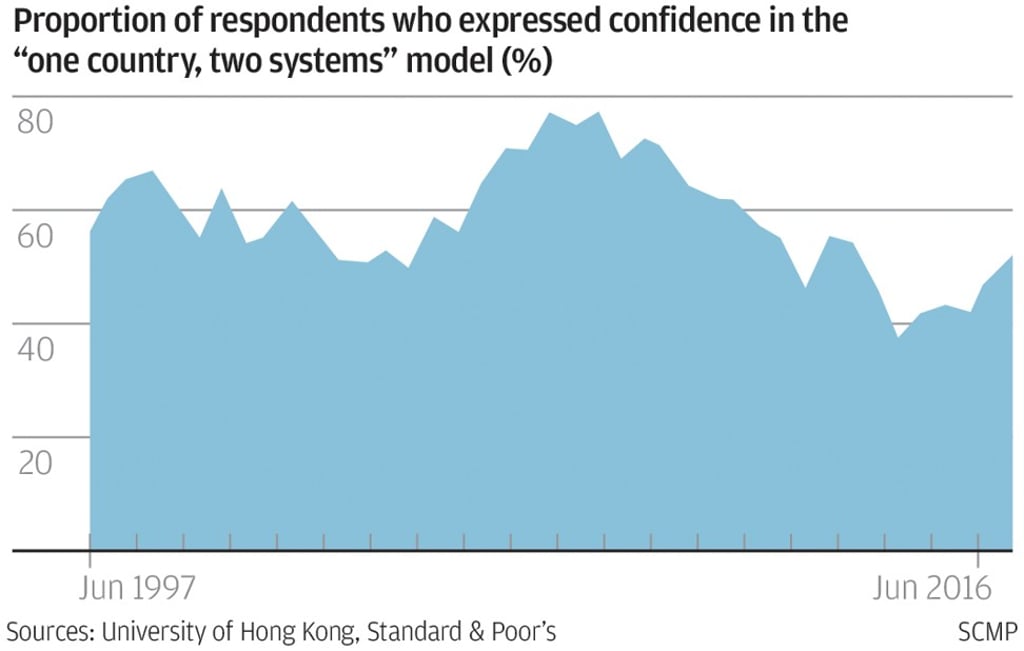

Hong Kong has maintained its “AAA” rating since it was first assigned in 2010, because the city’s economic, financial and governance systems were still separate and very different from the rest of China, in line with the “one country, two systems” framework, S&P said.