State Street says strong inflation boosts case for Fed December rate rise

‘Inflation is back on target’, says US investment bank, which has set its annual number as rising 2.5pc

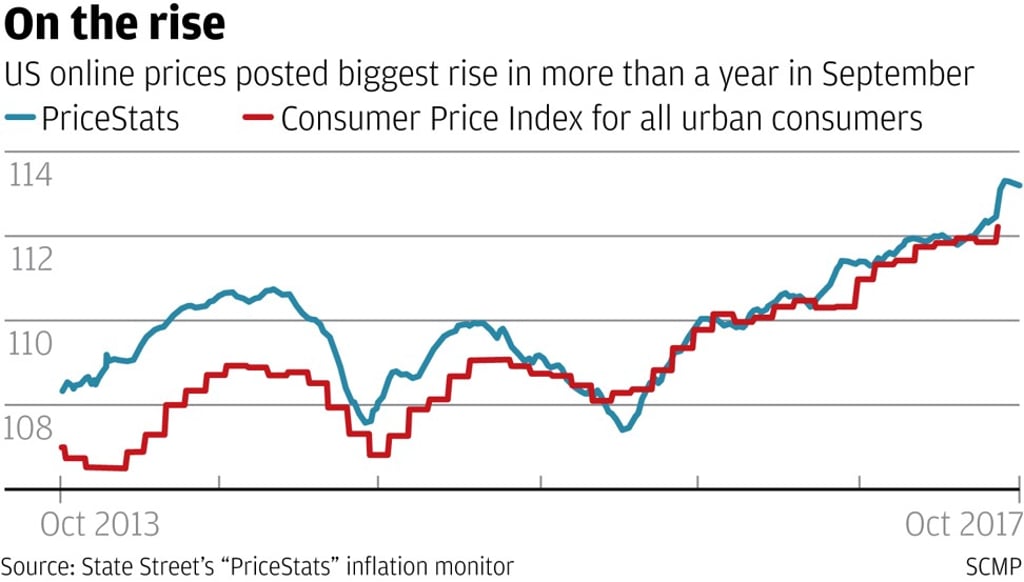

US inflation is back on target and set to hit 2.5 per cent this year, overcoming concerns from analysts and bolstering the case of a rate increase in December, according to new data from State Street Global Markets.

“One of the trends we’ve seen over the past month or so has been very, very strong US inflation throughout September,” said Dwyfor Evans, the US investment bank’s head of Asia Pacific Macro Strategy.

“[There is] a near universal expectation that the Fed will hike in December, and that to us, makes a lot of sense.”

Markets have now put a probability of around 75 per cent the Fed will lift rates in December.

Online prices rose 76 basis points in September, the biggest rise in more than a year, according to State Street’s “PriceStats” inflation monitor, which collects online prices to provide daily inflation updates for 22 economies, largely driven by driven by energy prices, Evans said.