State Street says strong inflation boosts case for Fed December rate rise

‘Inflation is back on target’, says US investment bank, which has set its annual number as rising 2.5pc

US inflation is back on target and set to hit 2.5 per cent this year, overcoming concerns from analysts and bolstering the case of a rate increase in December, according to new data from State Street Global Markets.

“One of the trends we’ve seen over the past month or so has been very, very strong US inflation throughout September,” said Dwyfor Evans, the US investment bank’s head of Asia Pacific Macro Strategy.

“[There is] a near universal expectation that the Fed will hike in December, and that to us, makes a lot of sense.”

Markets have now put a probability of around 75 per cent the Fed will lift rates in December.

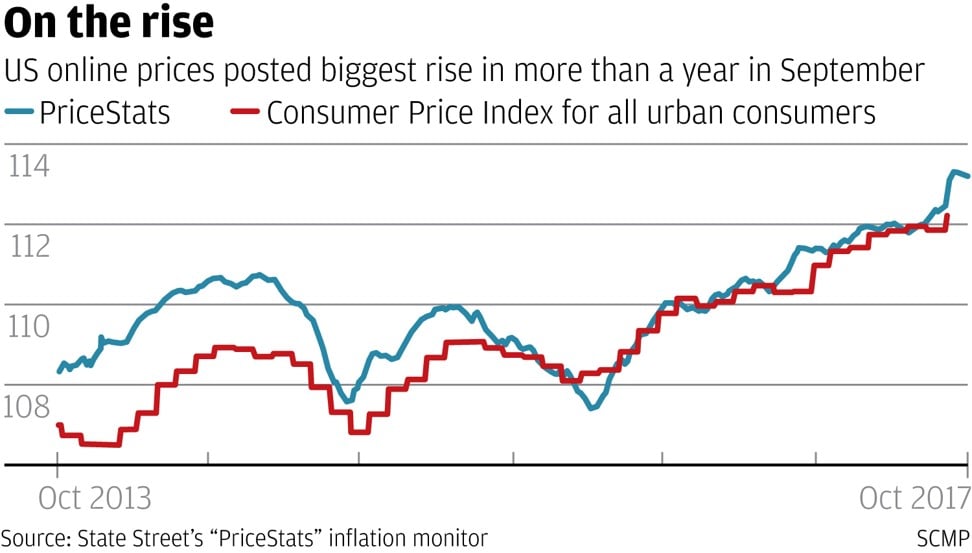

Online prices rose 76 basis points in September, the biggest rise in more than a year, according to State Street’s “PriceStats” inflation monitor, which collects online prices to provide daily inflation updates for 22 economies, largely driven by driven by energy prices, Evans said.

“The Fed likes to lead expectations and the comments about there being a prospective rise have not been made by accident,” he said.

“The comments are to specifically try and focus the market and drive market expectation towards a move by the end of the year, and that’s fair in the context of what we are seeing.”

“As far as the US is concerned, inflation is back on target, ” which Evans called a “significant step”.

He noted caution, too, that if this does signal “the beginning of a pickup in terms of inflation expectations, and clearly the Fed needs to be a little bit more aware of that markets have disbelieved its rhetoric [in the past]”.

Evans’ comments follow an extended period of low inflation for the world’s largest economy, which Fed Chair Janet Yellen has admitted remains a “mystery” to her.

The US central bank has repeatedly missed its target of a two per cent for core inflation, averaging 1.3 per cent since 2012 – despite a tight labour market and improved economic growth.

“I can’t say I can easily point to a sufficient set of factors that explain this year why inflation has been as low,” she said when asked by reporters last month.

Analysts seem to share State Street’s view that the US’ inflation landscape it likely to improve over the coming months.

Capital Economics wrote in a recent briefing note, that as the “updated projections from this week’s FOMC [Federal Open Market Committee] meeting made it clear a majority of Fed officials remain convinced the recent weakness of core inflation is mostly due to transitory factors and still expect to hike rates again in December.

It blamed widespread weakness and one-off idiosyncratic factors as playing the biggest role in that decision, and “as those forces start to fade, we expect core inflation to rebound again early next year”.

“The Fed will follow a December rate hike with four more hikes in 2018,” the research consultancy wrote.

“With the economy now close to full employment, we expect inflation to begin trending higher once again.”

Leading independent Australian economist Saul Eslake, who for 14 years was chief economist at the Australia and New Zealand Banking Group, echoed that view, though added, “the pace should continue to be gradual … and accompanied by clear and consistent communication as to the Fed’s thinking and aims”.

“I’m not really a betting man, but I would say a December rate rise is still more likely than not.”