Qihoo’s back-door listing approval could be followed by a select few other former US-listed Chinese tech firms

Returning companies considered in line with the mainland’s industry development strategies and which could take leading positions in their sectors could be fast tracked onto mainland exchanges

Qihoo 360 Technology’s approved back-door listing in Shanghai is unlikely to reopen the floodgates to many others, after firms were banned from buying shell companies in June 2016 by the Chinese mainland’s stock regulator to stop dozens of US-listed Chinese firms from returning to the A-share market.

But it is expected that a handful of carefully chosen market leaders with technology actively sought after by China will now be secured fast track approvals by the China Securities Regulatory Commission (CSRC) to gain A-share status, according to venture capitalists and analysts.

Anti-virus software maker Qihoo first announced its back-door listing plan at the start of November.

Controlled by its founder Zhou Hongyi, one of the country’s IT moguls, Qihoo was finally cleared on Friday by the China Securities Regulatory Commission (CSRC) to go ahead with a reverse merger that allows it a listing on the Shanghai Stock Exchange, after taking over lift maker SJEC Corp.

Analysts expect the next name likely to be given the nod could be AppTec, a leading domestic pharmaceutical and biotechnology firm, which awaits IPO approval on the mainland, after its parent Wuxi PharmaTech privatised in New York two years ago.

Independent economist Song Qinghui said it was an icebreaker moment for leading tech firms, and now expects to see a succession of Bell-whether firms list on the A-share market via either back-door listing or by initial public offering (IPO), although non-techs can expect that door to remain firmly shut.

Only those that “play a complementary role in the mainland market”, will be give approval, he added.

Five IPO applicants with variable interest entity (VIE) structures were also rejected by the CSRC, a sign the regulators is still wary of back-door listings.

A VIE structure means Chinese firms and foreign venture capital funds can set up an offshore vehicle which can sign contracts with the Chinese firms, via one or more foreign investment subsidiaries in China, giving effective control of the Chinese firms to the offshore vehicles. Chinese firms have typically used VIE over the past couple of decades, when seeking IPOs.

Qihoo completed its US$9.3 billion privatisation in New York in 2016. Amid the reverse merger, it also plans to inject 50.40 billion yuan (US$7.73 billion) worth of assets into the mainland-listed unit.

In the two years before the ban, more than 30 US-listed Chinese companies went private, with the sole intention of relisting on the A-share market where valuations, particularly for technology stocks, were much higher than on foreign exchanges.

CSRC spokesman Gao Li said in November, announcing the Qihoo deal, that returning companies which are considered in line with the mainland’s industry development strategies and which could take leading positions in their sectors were welcome on the A-share market, without elaborating.

“The regulator made clear it would grant the go-ahead to only those top firms,” said Cao Hua, a partner at Unity Asset Management.

“Only those firms that are in the same class as Qihoo are likely to get the CSRC nod to list here.”

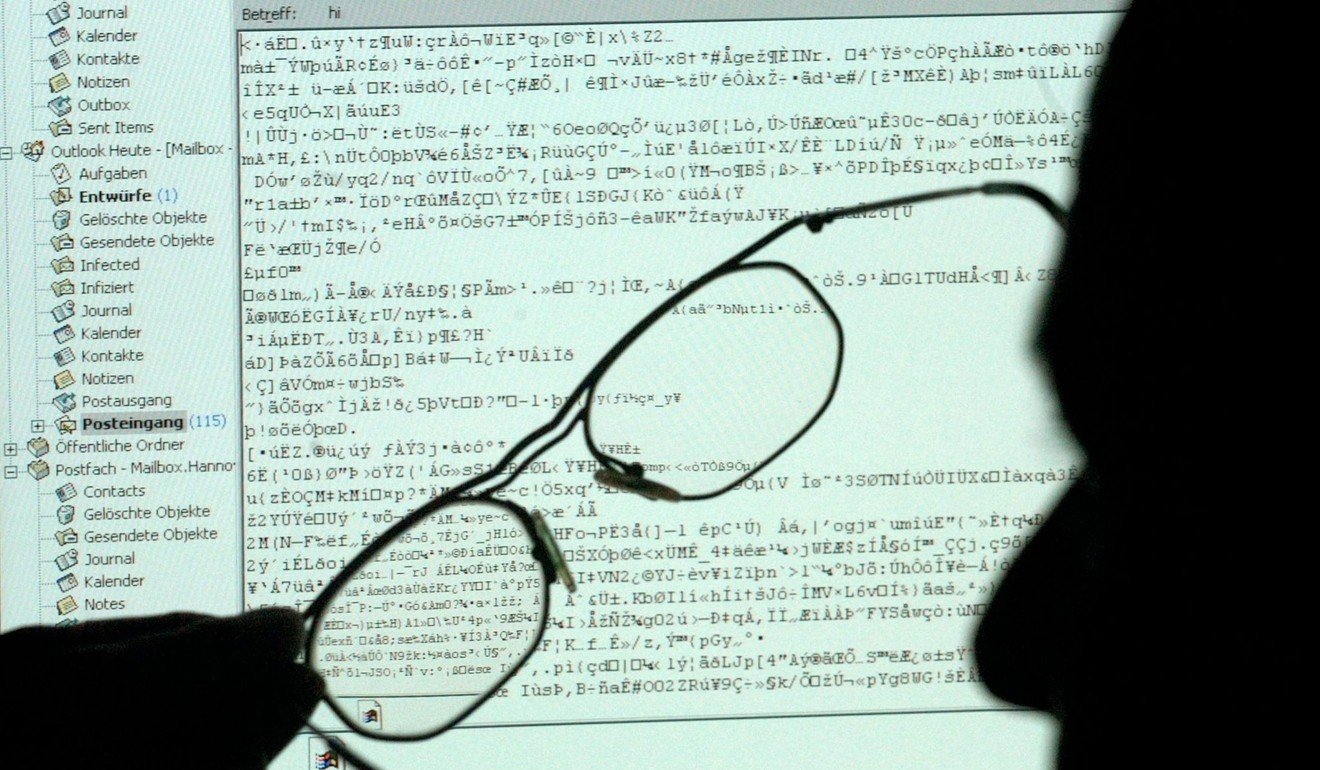

Qihoo holds a 95 per cent share of the mainland’s anti-virus software market for personal computers and a 67 per cent share for mobile devices.

Zhou Hongyi, its chief executive, said the status as a pure mainland company and an A-share stock would enable it to qualify for cybersecurity projects launched by national authorities and military.

Beijing is looking to further drive digitalisation of domestic businesses to improve efficiency in commerce, finance and manufacturing sectors.