Insider buying rebounds to HK$129 million

‘Significant buybacks were recorded in Vantage International, SinoMedia Holding and Century Sunshine Group. The buybacks in these three small cap stocks are worth noting as the firms have been buying back at progressively higher prices with heavy volume’

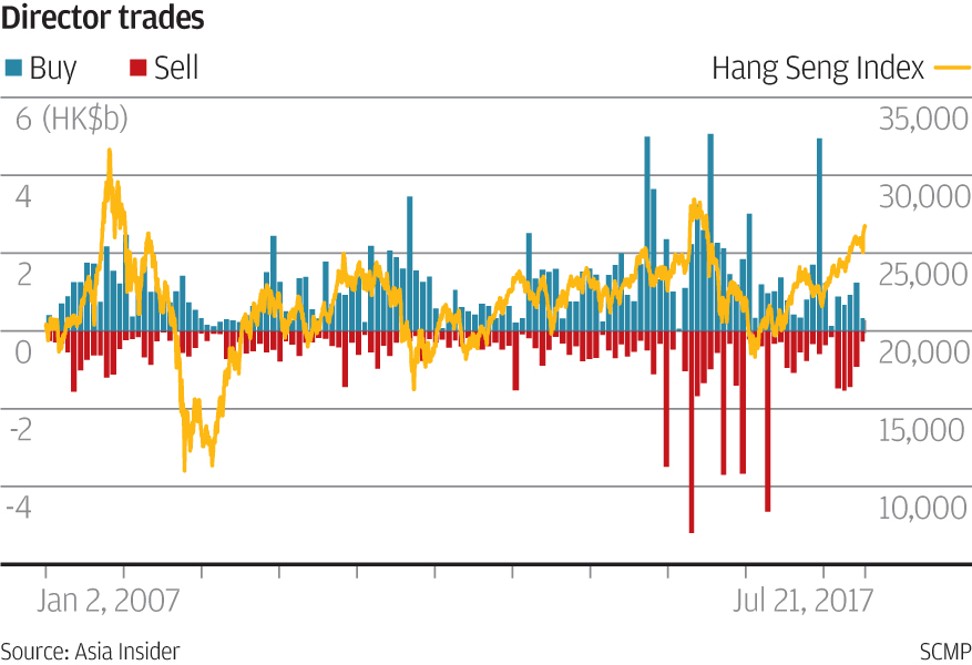

The insider activity rebounded based on filings on the Hong Kong stock exchange in the third week of July with 28 companies that recorded 206 purchases worth HK$129 million versus 13 firms with 63 disposals worth HK$41 million.

The number of trades and value on the buying side were up from the previous week’s 176 purchases worth HK$118 million while the number of companies was consistent with the previous week’s 29 firms. On the selling side, the number of firms and trades were up from the previous week’s 11 companies and 41 disposals. The sell value, however, was sharply down from the previous week’s disposals worth HK$183 million.

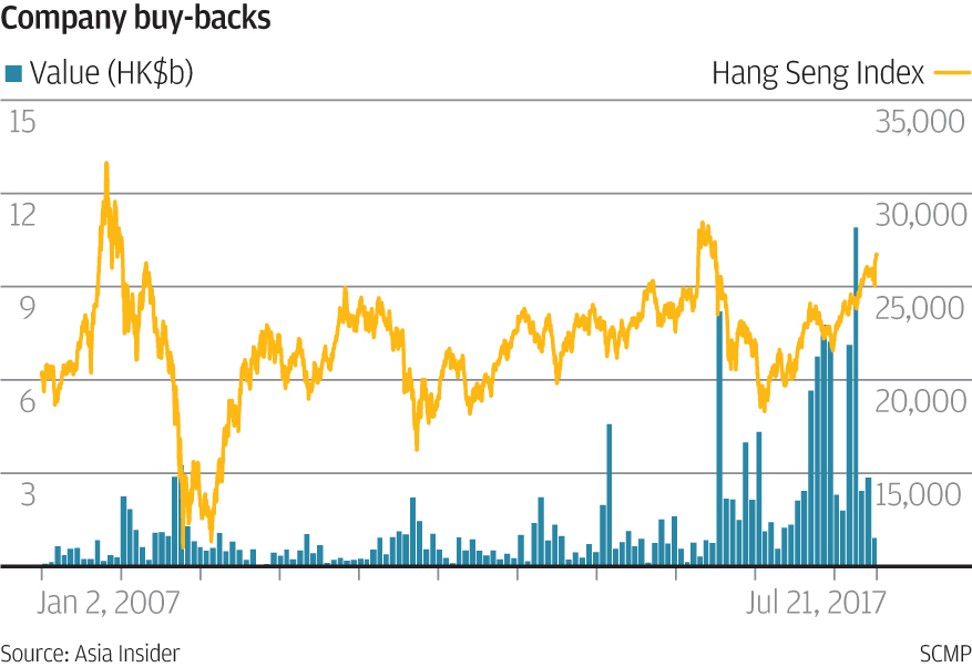

Meanwhile, buyback activity fell for the second straight week with 15 companies that posted 86 repurchases worth HK$185 million based on filings from July 14 to 20. The figures were down from the previous five-day total of 21 firms, 105 trades and HK$225 million.

Despite the fall in repurchases, there were several significant buybacks last week with buys recorded in Vantage International, SinoMedia Holding and Century Sunshine Group. The buybacks in these three small cap stocks are worth noting as the firms have been buying back at progressively higher prices with heavy volume.

Building construction, civil engineering, and renovation, repairs and maintenance services provider Vantage International has been buying back at progressively higher prices since the second half of June with 20.14 million shares purchased from June 26 to July 20 at HK$1.04 to HK$1.20 each or an average of HK$1.15 each. The group last bought 1.5 million shares from July 17 to 20 at an average of HK$1.19 each. Aside from the buybacks since June, the group acquired 5.86 million shares from April 18 to 21 at HK$1.07 to HK$1.17 each or an average of HK$1.14 each. The stock closed at HK$1.20 on Friday.

It is important to note that the company repurchased shares on 18 out of the 19 trading days since mid June.In addition, the trades accounted for 73 per cent of the stock’s trading volume and the buybacks were made after the stock rebounded by as much as 19 per cent from HK$1.01 on June 23.

The repurchases were also made after the company announced a 81.7 per cent gain in annual profit to HK$141.543 million on June 22.

Television advertising producer SinoMedia Holding has been buying since mid June with 3.6 million shares purchased from June 15 to July 20 at HK$1.58 to HK$1.85 each or an average of HK$1.67 each. Aside from the buybacks since June, the group acquired 6 million shares from January 3 to May 23 at HK$1.88 to HK$1.67 each or an average of HK$1.76 each.

The stock closed at HK$1.84 on Friday.

It is significant that the group bought shares on 11 out of the 26 trading days from June 15 to July 20, and the trades accounted for 16 per cent of the stock’s trading volume. The stock rose by an average of 10 per cent six months after the group bought back shares based on 190 filings since 2000. And the stock recorded a price gain six months after on 42 per cent of those filings.

Century Sunshine Group has been buying on the way up since the last week of June with 16.86 million shares purchased from June 30 to July 20 at HK$0.223 to HK$0.265 each or an average of HK$0.242 each. The agricultural technology company last bought 3.2 million shares from July 17 to 20 at an average of HK$0.26 each.

Prior to the buybacks this year, the group acquired 11.45 million shares in January 2016 at an average of HK$0.366 each, 23 million shares in July 2015 at HK$0.395 each and 34.56 million shares from July to September 2012 at HK$0.21 to HK$0.27 each or an average of HK$0.23 each. The counter closed at HK$0.265 on Friday.

It is notable that the group bought shares on 14 out of the 15 trading days from June 30 to July 20, and the trades accounted for 21 per cent of the stock’s trading volume. These buybacks were made after the stock fell by as much as 40 per cent from HK$0.37 in February.

The stock rose by an average of 67 per cent three months after the group bought back shares based on 17 filings since 2012. In addition, the stock recorded a price gain three months after on 100 per cent of those filings.

Robert Halili is managing director of Asia Insider