The Insider | Geely Automobile chairman Li Shufu strengthens grip on carmaker as stake rises to 46.18pc

Li bought 18.83m shares worth HK$470.6m, making him the top buyer in terms of value last week

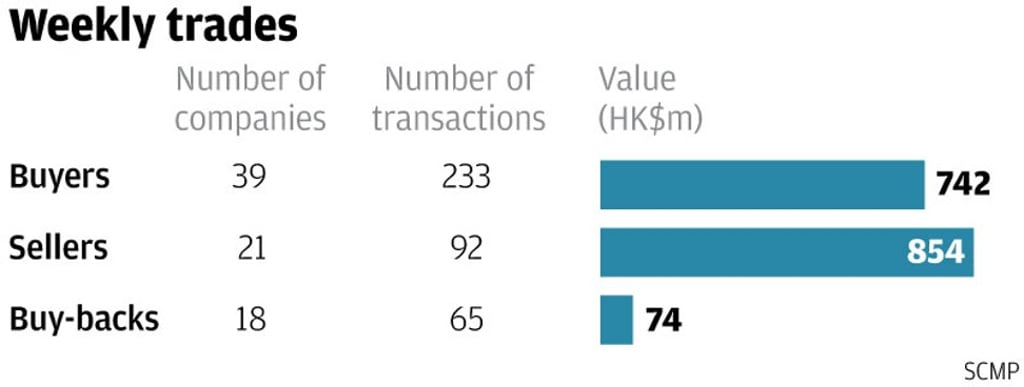

The director activity fell based on filings on the Hong Kong exchange from January 22 to 26 with 39 companies that recorded 233 purchases worth HK$742 million (US$60.3 million) versus 21 firms with 92 disposals worth HK$854 million. The number of companies and trades were down from the previous week’s 52 firms and 245 purchases on the buying side and 27 companies and 111 disposals on the selling side. The values, however, were up from the previous week’s purchases worth HK$266 million and sales worth HK$337 million.

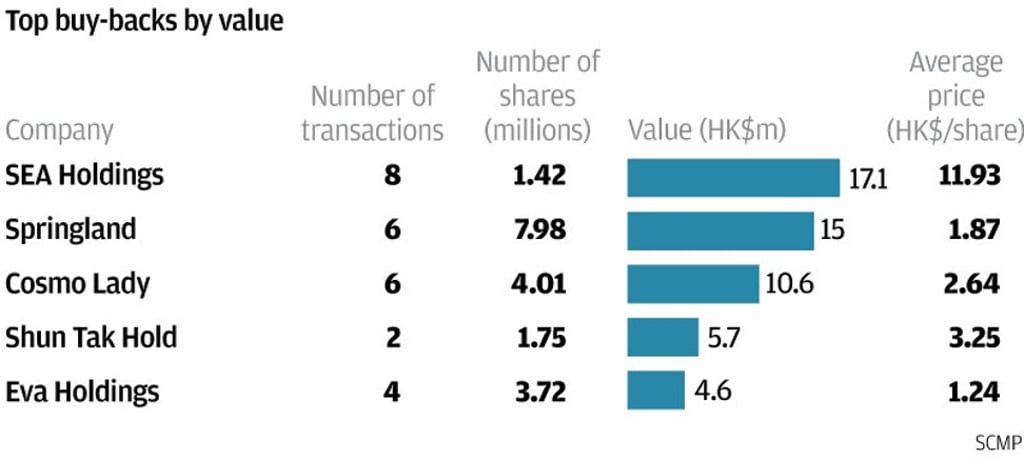

Meanwhile, buy-back activity fell after trading flat for three straight weeks with 18 companies that posted 65 repurchases worth HK$74 million based on filings from January 19 to 25. The number of firms was not far off from the previous five-day total of 19 companies. The number of trades and value, however, was down from the previous week’s 73 transactions worth HK$139 million.

There were several significant trades last week with rare insider buys in Geely Automobile Holdings and Luk Fook Holdings (International), and rare sales in Computime Group and EPI (Holdings).

Geely chairman Li Shufu was the top buyer in terms of value last week with 18.83 million shares worth HK$470.6 million in the carmaker on January 19 at HK$24.99 each. The trade increased his holdings to 4.143 billion shares or 46.18 per cent of the issued capital. He previously acquired 119 million shares in December 2016 at an average of HK$8.19 each. Li also acquired 8.8 million shares in January 2016 at HK$3.49 each and 23.1 million shares from November 2014 to July 2015 at an average of HK$3.14 each. Li joined the group in June 2005. The stock closed at HK$25.10 on Friday.