Advertisement

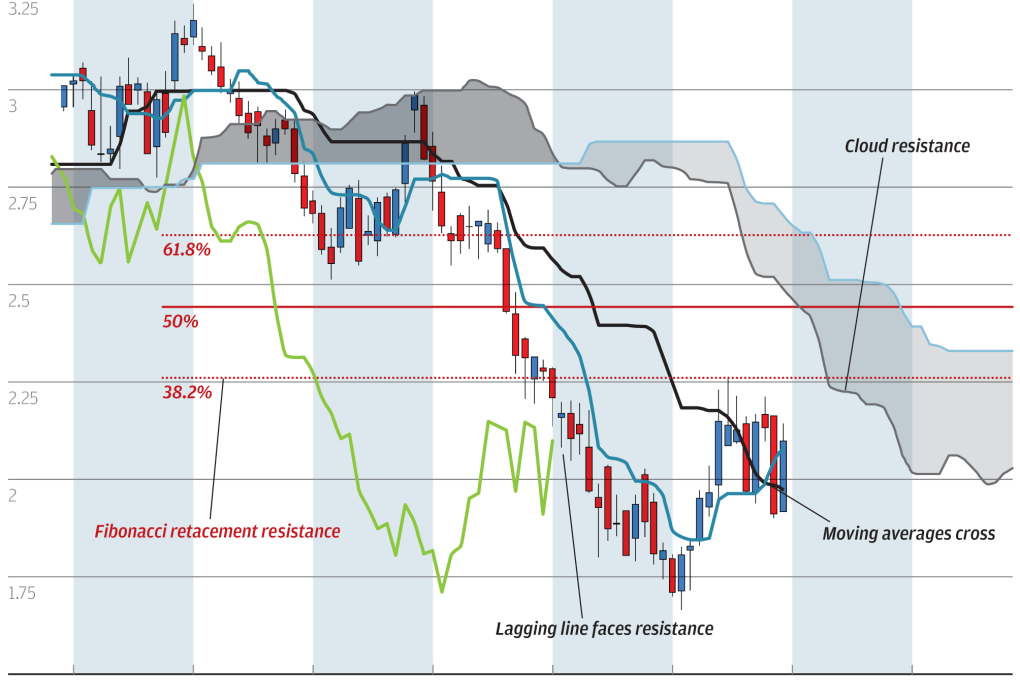

The steep drop in the yield of benchmark Australian three-year Treasury notes started in 2014 and came to an abrupt halt at a record low 1.665 per cent early in January. The subsequent back up was equally sharp, with yields thrashing around 2 per cent for weeks now - causing moving averages to cross. This has probably troubled the Reserve Bank of Australia, which has been in easing mode since 2011 and has slashed the cash rate to a record low 2 per cent Relief might be in sight in that note yields appear capped at 2.25 per cent with cloud and Fibonacci retracement resistance. This should force rates back down to the record low in the second half of this year.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x