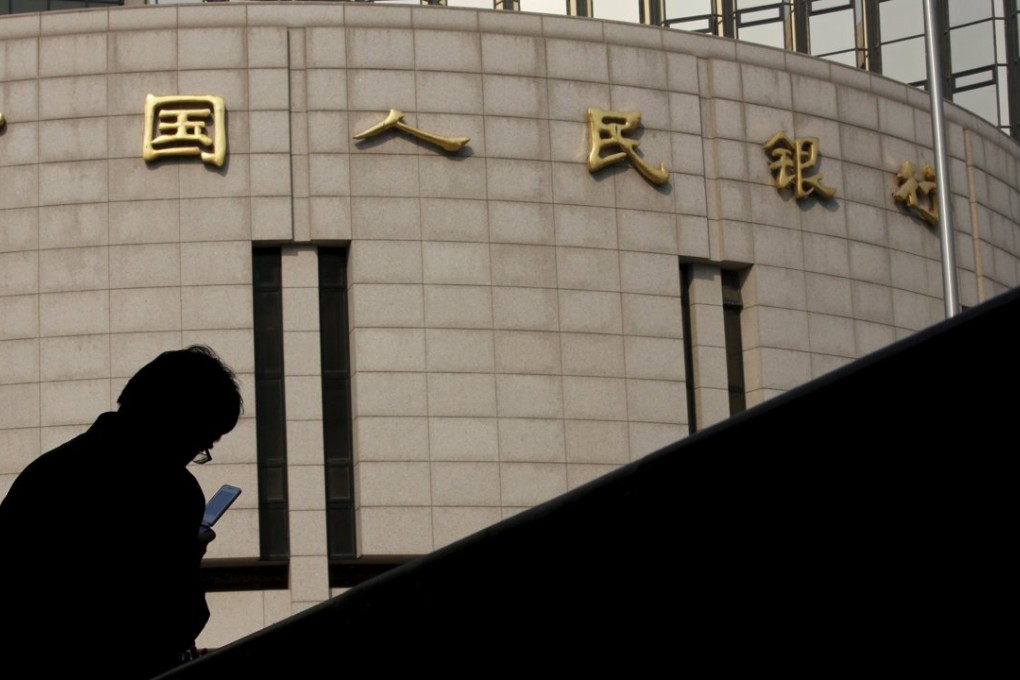

Breaking | Offshore yuan interest rate rockets to 200 per cent, with the People’s Bank eager to punish speculators

Spread between Shanghai and Hong Kong traded yuan narrows as interbank borrowing costs hit record high

The battle between the People’s Bank of China and currency speculators has led borrowing costs for offshore yuan in Hong Kong to shoot up to 200 per cent Tuesday, with analysts saying the central bank is keen to defend the currency and fend off speculative attacks.

The PBOC through several mainland banks banking network has continued to intervene in the offshore yuan market to buy yuan and sell the US dollar Tuesday, the second day of heavy intervention this week, analysts said. This has weighed negatively on liquidity and led speculators and other traders to raise cash at high cost to cover their positions, boosting offshore yuan and narrowing the spread between the onshore and offshore yuan.

The Hong Kong interbank offered rate for offshore yuan, or CNH Hibor, rose to 200 per cent Tuesday afternoon after hitting 66.815 per cent for overnight funding on at the 11.15am fixing , a record high since the Treasury Market Association launched the fixing in 2013. The fixing shot up 10 percentage points on Monday to 13.396 per cent.

Offshore yuan strengthened as a result of the PBOC actions, rising to 6.5650 Tuesday afternoon, up 0.12 per cent from Monday’s close, which gained 1.48 per cent from the previous session.

The two day advance more than offset last week’s 1.75 per cent devaluation, which saw the currency hit a record low of 6.7511 per US dollar on Thursday.

Jasper Lo Cho-yan, a director of Tung Shing Futures, said currency traders were struggling to access offshore yuan Tuesday as some mainland-based banks refused to sell the currency.