New | Beijing seeks to soothe investor angst with cash and an open door while stepping up tirades on George Soros

State media steps up attacks on Soros to safeguard “stable” market

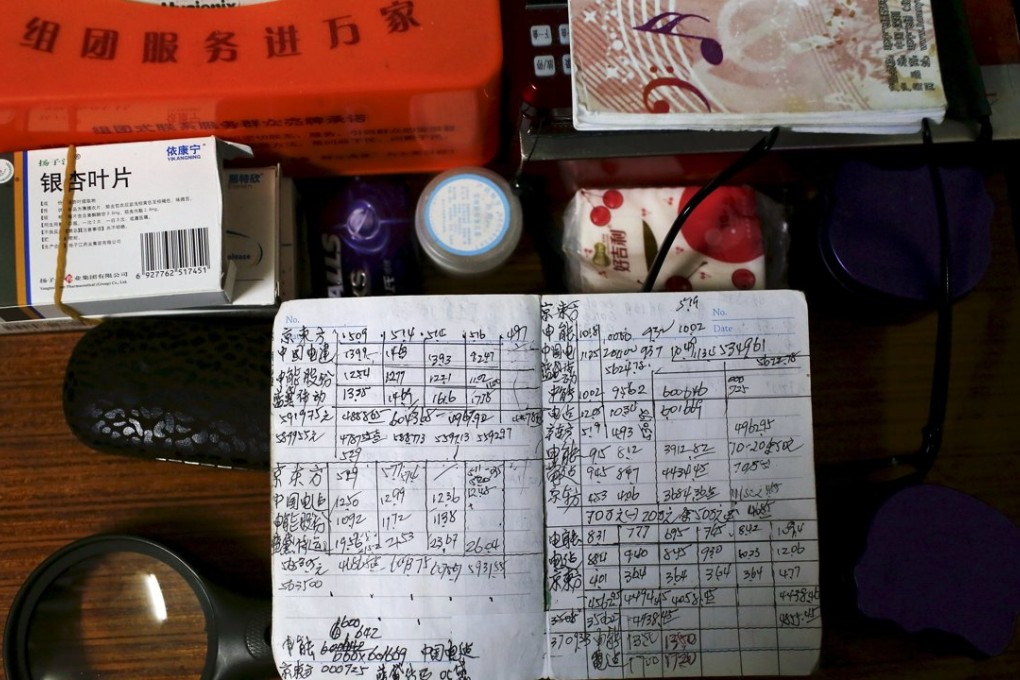

Beijing is trying every measure to calm the nerves of domestic and international investors as its seeming inability to tame falling financial markets has caused concern and sparked pressure as money is pulled out of China.

The central bank plunked down its biggest cash injection in three years in a bid to fill a credit crunch left by recent capital outflows and to meet heavy funding demand before the Lunar New Year on February 8.

The People’s Bank of China (PBOC) pumped a net 590 billion yuan through short-term loans, known as reverse repurchase agreements, to commercial banks by Thursday this week, the biggest since February 2013 and just after last week’s 1.5 trillion yuan injection through gross short- and medium-term lending to banks.

The eye-popping injection has failed to bring down interbank lending rates or lift the sour mood in the stock market, with the benchmark Shanghai Composite Index plunging 8.95 per cent in the four trading days of the week.

To ease foreign companies concerns China will shut the door on capital looking for an exit, the State Administration of Foreign Exchange (SAFE) clarified its stance on its official Sina Weibo account on Thursday.

“SAFE has not made any change to policies, regarding to some reports claiming the authority will curb foreign companies repatriating their earnings made in China,” the gate keeper of China’s foreign exchange said.

On another front, China’s state media stepped up attacks on George Soros and said the government remains firm in safeguarding “stability” in the country’s financial markets.