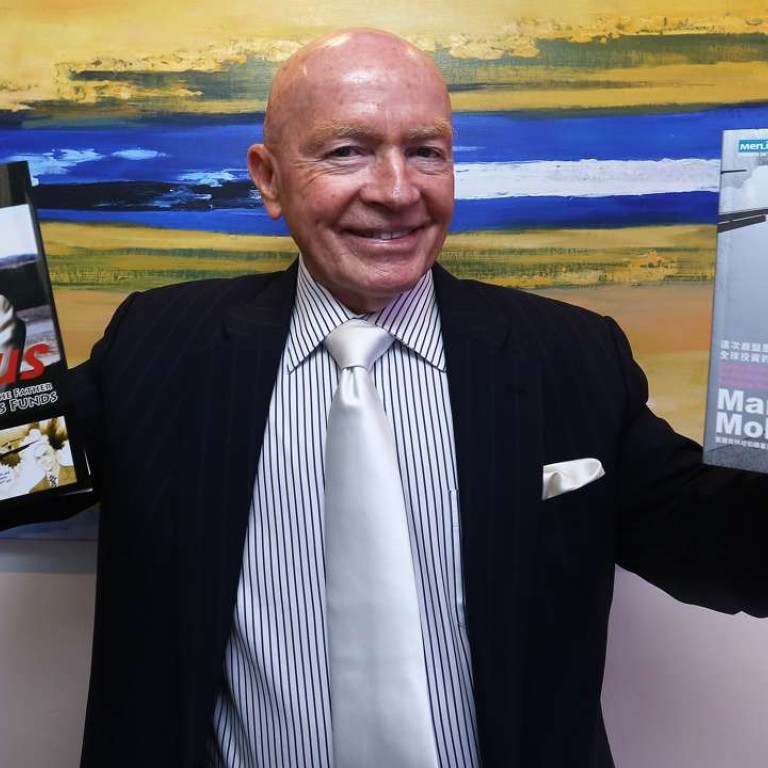

Emerging markets veteran closes in on 80 but has no plans to retire

Mark Mobius says age does not make fund managers wiser

Emerging markets guru Mark Mobius will turn 80 this August but he says he has no plans to retire, joking that he’s aiming for the Guinness world record as the oldest fund manager.

On Friday, he will relinquish day-to-day management work to chief investment officer Stephen Dover, but he’ll continue to act as executive chairman of Templeton Emerging Markets Group.

“It does not make sense for me to retire or to have vacation,” he said. “I enjoy my work so I will just keep going to work and invest for the investors. I may delegate some daily operational work to my colleagues but I won’t retire.

“I learn something new every day. It is so much fun to travel around the world visiting different markets and different companies.”

Mobius was born in New York in 1936, the son of a German migrant. He opted to abandon his US citizenship about 18 years ago and became a German citizen.

I found out if you are a fund manager you can visit many different countries and study many different companies, which was what I like to do

“I travel around the world, about 200 days a year, and have always been away from America,” he said. “ A German citizen can travel easily internationally, particularly to some emerging markets. Some market, such as Cuba, did not allow US citizens to travel there.”

The veteran fund manager’s family background has nothing to do with finance but did give him exposure to different cultures. His father, Paul Mobius, was cook and baker who worked on ships sailing between Europe and the United States. His mother, Maria, was from Puerto Rico, and his parents moved to New York after they married.

He studied fine arts, music, theatre, psychology, journalism and economics and eventually chose fund management as his career after completing his university study.

“I am interested in many things and many different cultures,” he said. “I found out if you are a fund manager you can visit many different countries and study many different companies, which was what I like to do.”

He visited many Asian countries and arrived in Hong Kong in 1967. He set up a research and consulting firm in the city and visited mainland China from time to time.

‘Back then, all the people wore blue-coloured clothes and Shanghai was so quiet,” he said. “Foreigners needed to use special currency and people needed rice coupon for food.”

He began shaving his head at that time after a fire burned his hair and it has since become something of a trade mark, prompting friends to compare him to movie star Yul Brynner.

He sold his research firm in Hong Kong after 15 years and then worked for several investment companies, covering Asia, until he was almost 50. He then got a call from fund manager John Templeton asking him to set up Templeton’s first emerging market fund for the American public.

The fund he established with US$100 million in 1987 rose to US$40 billion at its peak in 2007 before falling to its current level of US$26 billion. The fund initially covered only five markets, including Hong Kong and Taiwan, but now covers 50, with mainland China and Brazil his favourites.

“Emerging markets have had high growth over the past 30 years,” he said. “There were risks and crises during the period.”

To make sure he can do research on companies, he insisted Templeton set up offices in Hong Kong and other emerging markets so that he and his team can visit factories, meet management and check the social and political environment in order to make the right investment decisions.

“It is a lot of hard work,” he said while sharing photos of his plant visits.

The fund has seen outflows in recent years due to the slowdown in the mainland economy and worries about Brazil and Russia, but Mobius said those markets would bounce back in the long term.

Looking back at his investment history, he said he was most proud of investing during the Asian financial crisis in 1998, reaping strong returns when the market bounced back.

In terms of individual stocks, he said the best return was brewery company Anheuser-Busch InBev, which gave him a profit five times his initial investment. “You don’t often get a return like that,” he said.

A shares should be included in MSCI index, says emerging markets guru Mark Mobius

His worst investment was Singapore-based Asia Pulp & Paper (APP), which took on mountains of debt while expanding into China. A sharp fall in global paper prices in 2001 caused its profits to decline, and APP was unable to repay debts in the form of loans and bonds totalling US$13.9 billion. Its share were delisted from the New York Stock Exchange when its American depositary receipts fell to 10 US cents in 2001 from a high of US$16 in 1997.

“This company had corporate governance issues,” he said, warning that investors needed to look for quality management and strong corporate governance.

Mobius said he had no plans for an 80th birthday party and just planned to work as usual.

He also said he did not believe fund managers became wiser with age.

“Experience is important but age does not really matter in terms of making a better investment choice,” he said. “What is more important is not to let your experience prevent you from learning new things such as the internet, or otherwise you miss the opportunities.”

Mobius has accounts on social media platforms including Facebook, Twitter and LinkedIn and has his own blog to share investment tips.

He has written several books on investment and featured in a comic book biography by Kaoru Kurotani that was published in 2007.