Advertisement

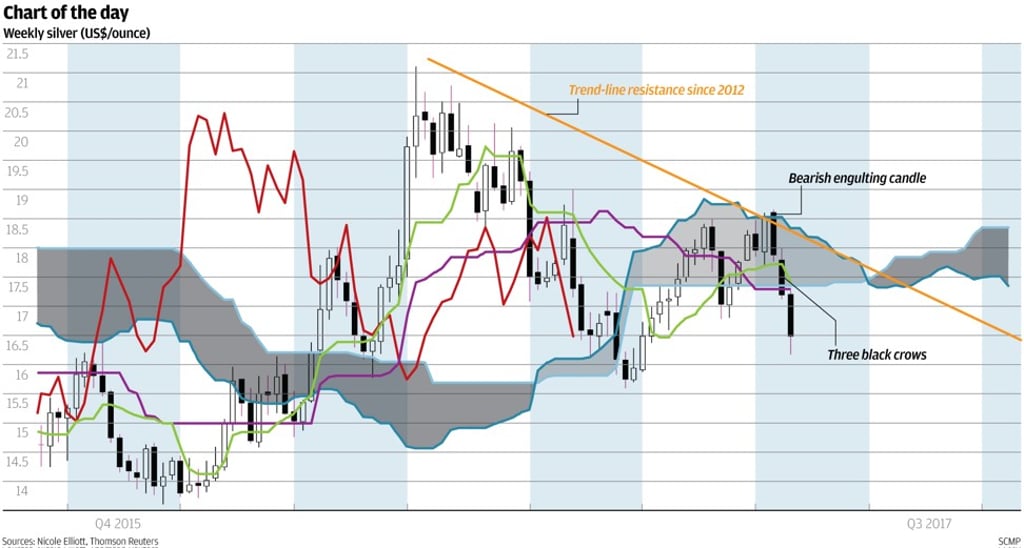

For almost three years silver has been cheap relative to gold, a tendency which has accelerated since April so that today one needs 75 ounces of silver to buy one of gold instead of just 68. You can see this clearly in the candlestick chart with three large consecutive weekly falls in spot silver, a chart pattern known as three black crows, which started with a bearish engulfing candle against the top of the weekly cloud. The move reinforces the power of secular trend-line resistance drawn from 2012’s high (not 2011’s record high at US$49.50 per ounce) and suggests prices will fall back down through December’s low at US$15.50 to US$14.50, maybe 2015’s low at US$13.60.

Nicole Elliott is a technical analyst

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x