Hong Kong, China regulators agree on plans to introduce investor identification scheme by late 2018

Hong Kong’s current trading systems only show the brokers’ names and client identification is only provided to the SFC upon request

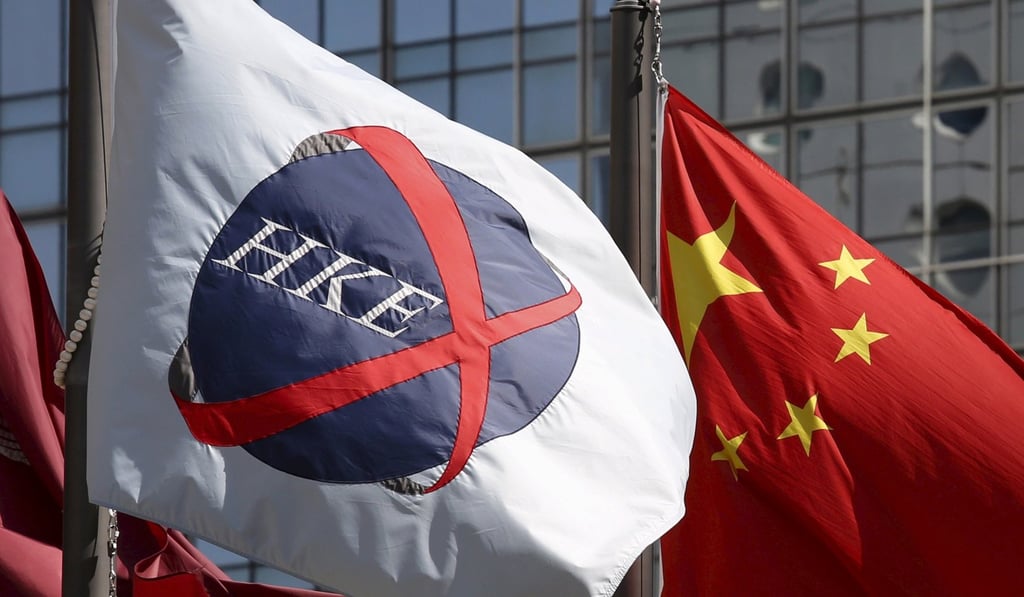

Hong Kong will start sharing stock investor identities under the cross-border Stock Connect share trading schemes with mainland Chinese regulators by the third quarter of 2018, the Securities and Futures Commission (SFC) said on Thursday.

The SFC has reached agreement with its counterpart, the China Securities Regulatory Commission (CSRC), on proposals to introduce an investor identification regime for northbound trading under the schemes.

Currently, Hong Kong trading systems only show brokers’ names and client identification is provided only if requested by the SFC. On the mainland, however, each investor is identified, so the CSRC knows who is behind every transaction.

The regulatory differences have created problems for the two Stock Connect schemes, which allow investors to engage in cross-border trading between the Hong Kong, and Shanghai and Shenzhen bourses.

The implementation of the new regime will allow the collection and use of personal data by the Hong Kong stock exchange, as well as its transfer to the mainland exchanges and the CSRC, the SFC said.

It will work with the Hong Kong exchange to facilitate the collection, use and transfer in accordance with all applicable data privacy laws and principles.