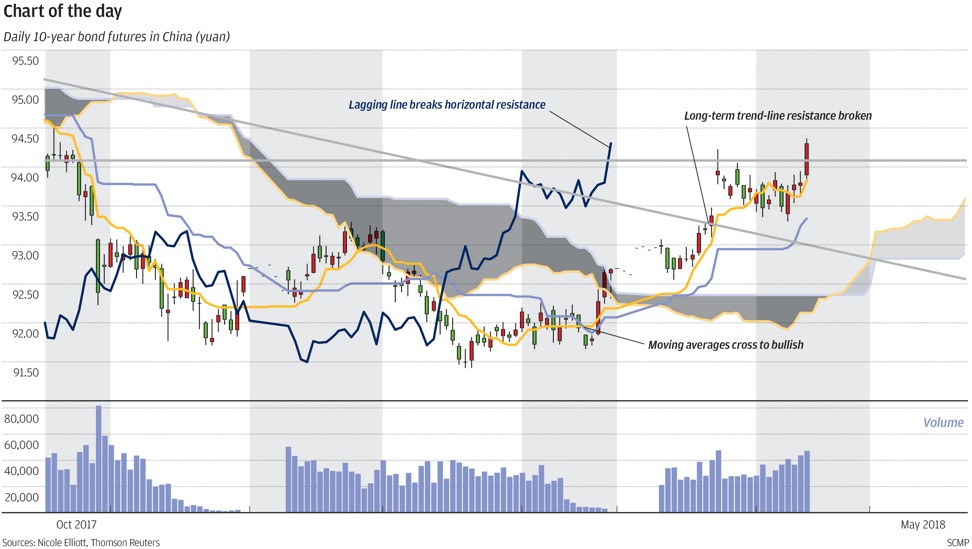

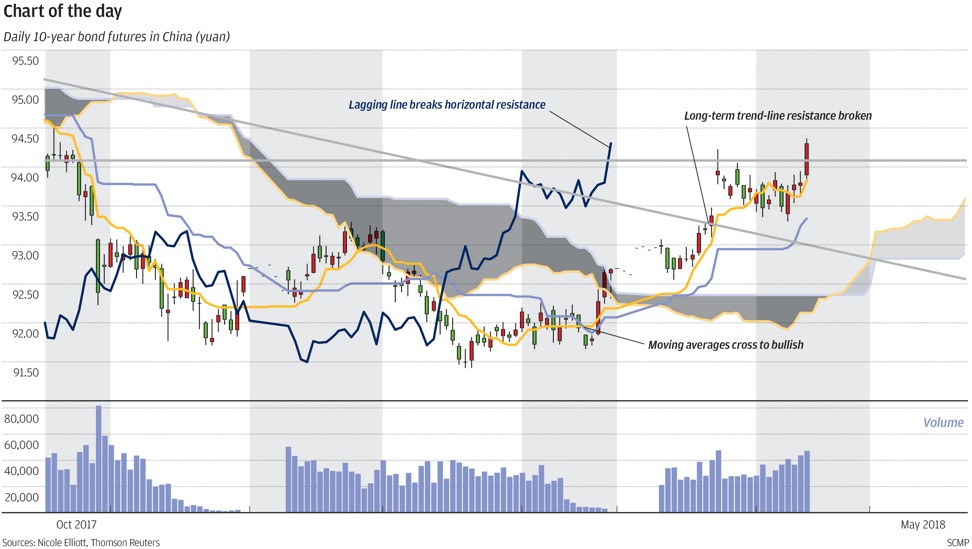

On Monday, the People’s Bank of China raised the rate on 14-day reverse bond repurchases by 5 basis points to 2.7 per cent, while simultaneously adding 150 billion yuan (US$24 billion) into the money market. As it was doing this, the 10-year bond futures rallied strongly through the important resistance level at around 94.10 yuan, taking the benchmark 10-year yield to 3.718 per cent, its lowest since mid-October. This mirrors the US yield curve, which is flatter than it has been since 2007 despite the Federal Reserve’s tightening policy. We feel Monday’s move heralds the start of a steady rally towards last year’s high of 97.90 yuan. As bond vigilantes know, they do not necessarily dance to the central bank’s tune.