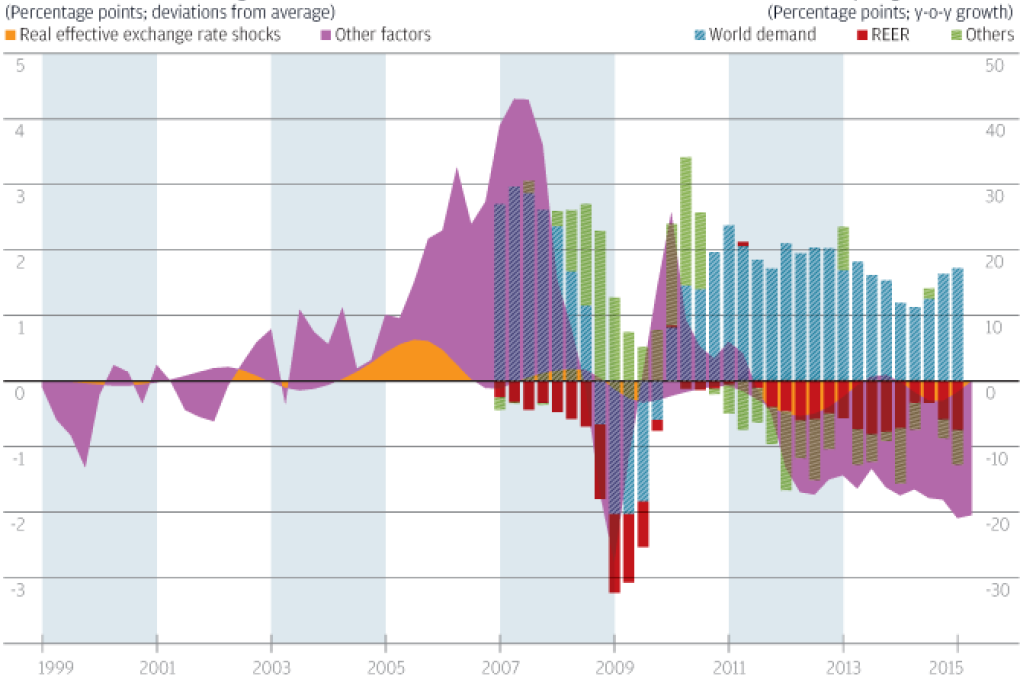

Beijing's decision to allow more flexibility in the yuan's central parity rate divided market participants. For some, the move increased global disinflationary pressures by cheapening Chinese exports. Others saw the shift as a call to arms, with China joining a currency war. The critical issue, according to analysts at Bank of America/Merrill Lynch, centres on how meaningful is the depreciation that was engineered? Their analysis of the real effective exchange rate in relation to export growth and overall economic growth is presented in a new report. It concludes that yuan appreciation since 2010 has likely sliced 5 percentage points off annual export growth in recent quarters, so a depreciation might benefit exports near term. But the structural shift in China's economy over the same period means there is close to no impact on overall growth. At best, the small depreciation seen could plausibly add one or two-tenths of a percentage point to growth. Hardly a game changer.