New | Singapore fintech Smartkarma enters Hong Kong for equity and China exposure

Smartkarma, a Singapore-based financial technology company, has opened a Hong Kong office this month with the ambition to challenge high-cost investment research services of traditional financial institutions.

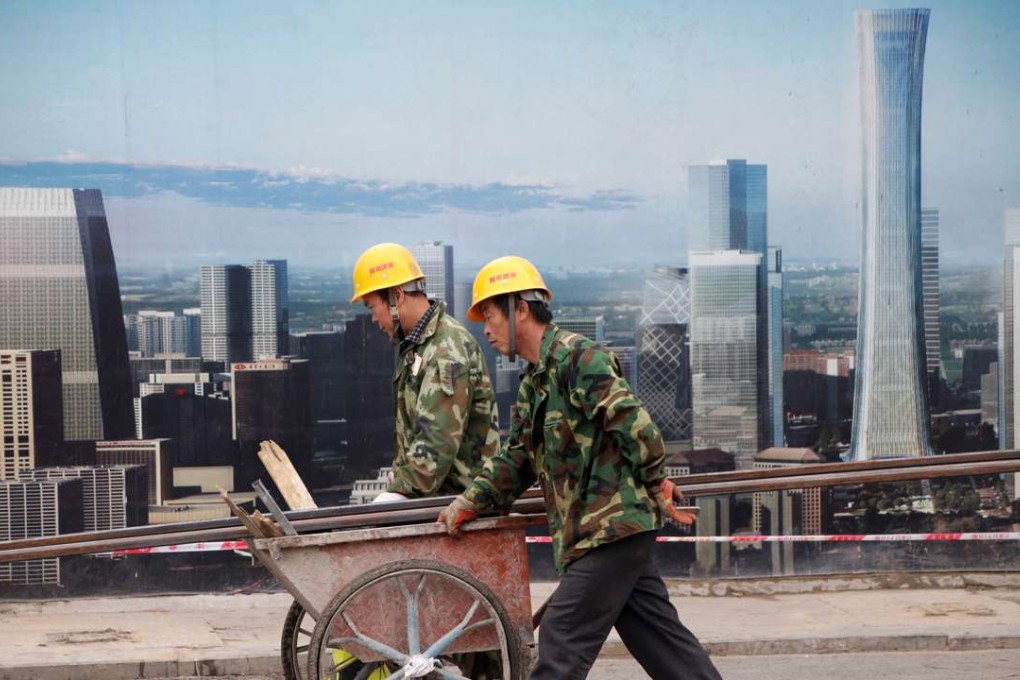

Chairman and co-founder Jon Foster expects Hong Kong to strengthen its equity research content and insights into China, as more and more clients are interested in investing in the world’s second-largest economy.

Smartkarma is an online platform that offers Asia-focused financial analyses from independent research institutions, ranging from the Chinese economy to the malfunctioning batteries in Samsung’s Galaxy Note 7 phones.

The two-year-old start-up makes money by charging flat fees from subscribers – the institutional investors worldwide such as fund managers – for access to independent research insights and data tools, and it pays research providers based on the value add to the platform.The firm does not have in-house analysts.

Hong Kong strengthens our offering in the equity space, a focus area for many of our insight providers and institutional investors

Foster said it chose Hong Kong as the first expansion step as exposure in the city will help increase its client base and equity research content.