Wheelock and Co announces 525 per cent increase in interim dividend

After a payout ratio below 10 per cent since 2003, property and logistics firm changes the rules to increase distributable earnings by 525 per cent

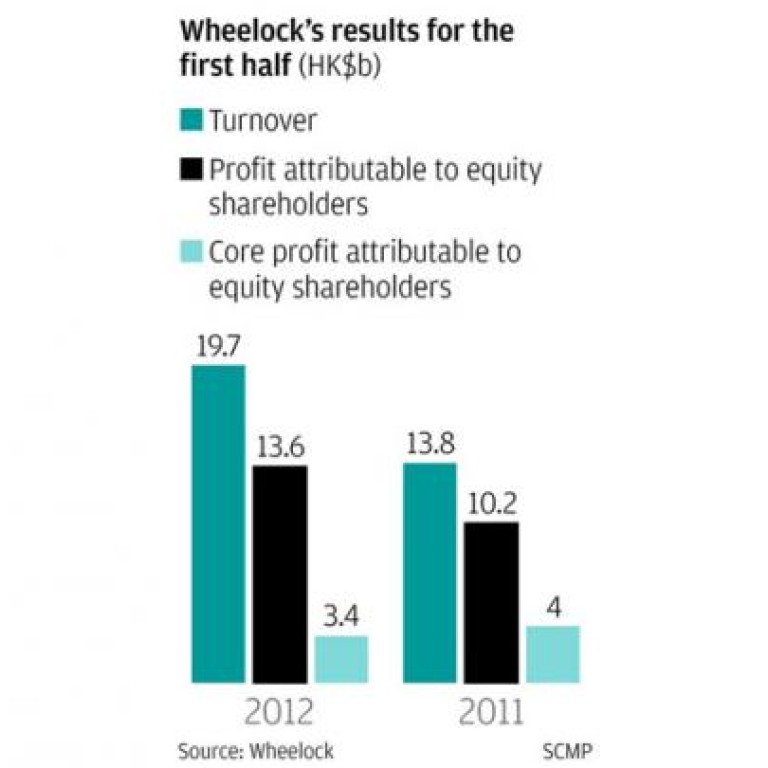

Property and logistics conglomerate Wheelock and Co will reward shareholders with an interim dividend for the six months to June of 25 HK cents per share on net profit that was up 33 per cent to HK$13.57 billion.

The dividend was up 525 per cent on the dividend of 4 HK cents declared for the first half of last year.

Deputy chairman Stephen Ng Tin-hoi said the big increase in the dividend was partly due to a change in the company's dividend payout policy. Ng said the payout ratio - the percentage of earnings distributed as dividends to shareholders - had been below 10 per cent since 2003.

Directors now hoped to increase the ratio, he said, although the size of the increment was not yet finalised.

Meanwhile, Ng said the company had formerly declared a smaller dividend in the first half and a bigger payout in the second half, and it would now seek to narrow the difference between the two.

His comments came at a conference to announce Wheelock's interim profit result, which showed a 43 per cent jump in turnover to HK$19.71 billion in the first half. The major profit contributor was 51.06 per cent owned Wharf (Holdings), which on Thursday announced a HK$5.43 billion first-half net profit, an increase of 49 per cent.

However, Ng said the bigger contribution from Wharf was offset by smaller profit from its wholly owned subsidiary Wheelock Properties - the company's property development arm in Hong Kong.

"In the absence of Wheelock Properties' lucrative profit that was recognised from the wholly owned One Island South development in 2011, core profit dropped year on year by 15 per cent to HK$3.39 billion," he said.

But Ng emphasised that "despite the lower contribution, as the property development arm of the group in Hong Kong, Wheelock Properties is the business focus of the group".

Vice-chairman Stewart Leung Chi-kin said the group targeted an annual completion of 1 million square feet of floor area every year. "This will make the company's share in Hong Kong's property market 12 to 15 per cent," he said.

The group, which has a land bank of 6.6 million sq ft, will aggressively acquire land sites through channels such as government tenders and auctions.

Ng said the annual completion target was achievable in view of the company's upcoming projects. For example, a residential development above Austin Station, a 50-50 joint venture with New World Development, would have an attributable area of 641,000 sq ft on completion in 2014-2015.