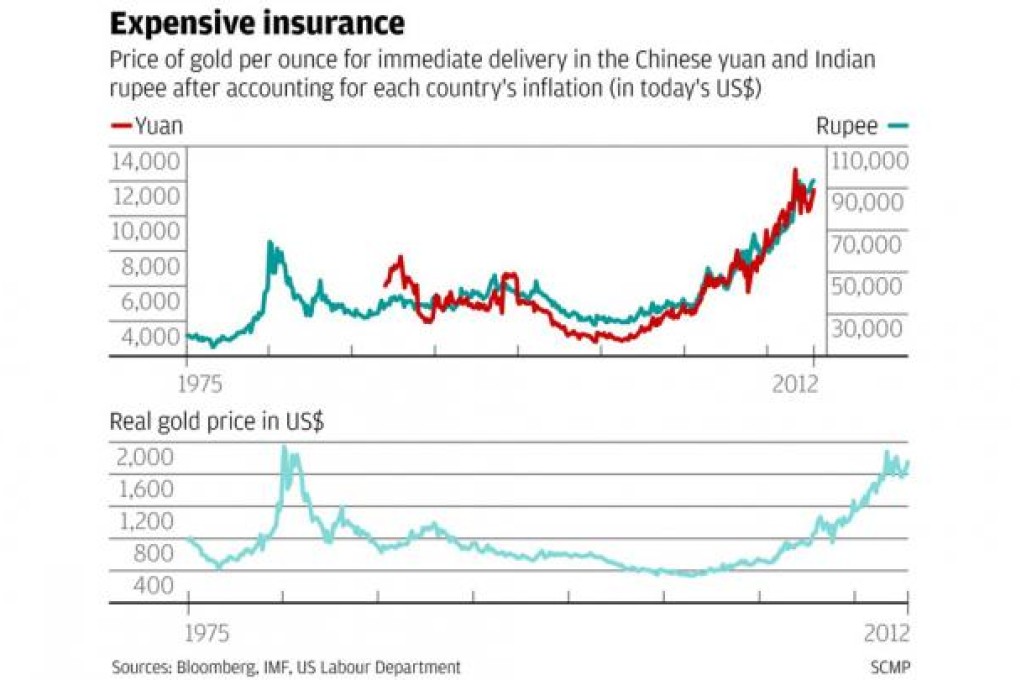

Gold is costlier by historical standards for the world's two largest buyers, China and India, than for the United States and other countries.

As the chart of the week shows, the price of gold has risen to records in the Chinese yuan and Indian rupee after accounting for inflation.

In today's dollars, the price is still below the 1980 peak of more than US$2,500 an ounce.

"No matter where you are in the world, gold is expensive tail risk insurance," says Claude Erb, a co-author of the study. Tail risk refers to the potential for a plunge in asset prices because of an unusual event.

Gold's real price may play a comparable role to price-earnings ratios for stocks, according to Erb and Professor Campbell Harvey of Duke University. Their research examined 23 countries, 10 of which are emerging markets.