Factory numbers add to market optimism

Buyers have pushed the Hang Seng Index up by 11. 2 per cent from September but some brokers expect a correction and uncertainty ahead

The stock market rose more than 500 points in two days to reach a two-week high yesterday on higher expectations of an improved economy on the mainland.

The Hang Seng Index closed higher by 218 points to 21,743 yesterday, adding to the increase of 296 points on Wednesday.

The market rallied two days ago on speculation that the People's Bank of China might cut the reserve requirement ratio for banks, Francis Lun Sheung-nim, the managing director of Lyncean Securities, said.

Its better performance yesterday was due to the favourable preliminary Purchasing Managers' Index (PMI) figures for China released by HSBC.

"I suppose the market will fall and adjust on Friday and will continue to correct next week," he said.

He expected the market to stabilise around 21,200 points.

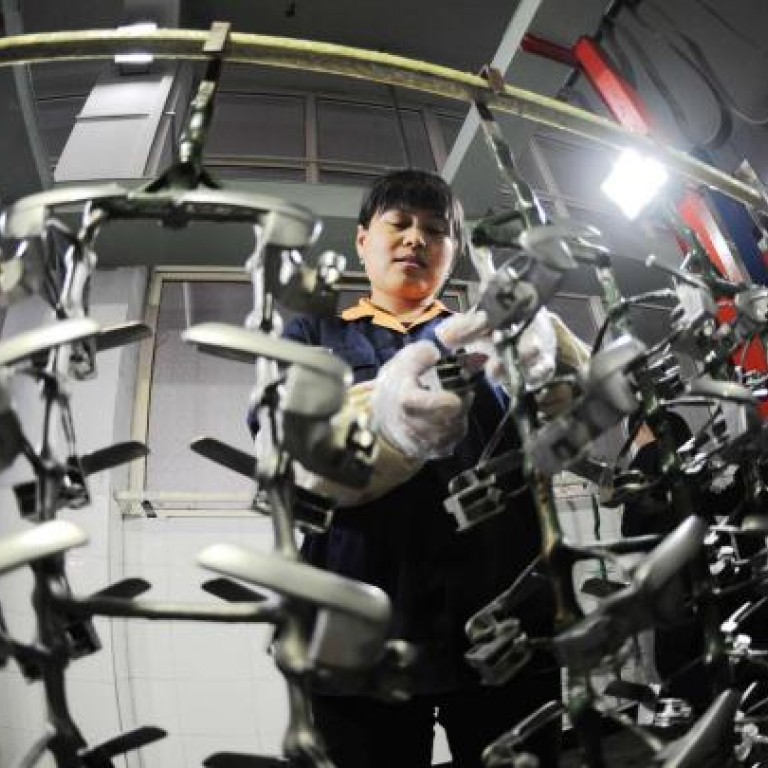

HSBC published its monthly PMI estimate yesterday, showing a jump to 50.4 this month from 49.5 to hit a 13-month high. A reading above 50 indicates expansion in the manufacturing sector.

The stock market has been warming up over the past two months - the HSI has climbed 11.2 per cent since the beginning of September - and the hibernating initial public offering market is coming back to life.

At least five companies have announced they are seeking Hong Kong listings since the beginning of this month.

They include Shanghai-based property developer CIFI and the mainland's largest non-life insurer by premiums, the People's Insurance Company of China.

But Louis Tse Ming-kwong, a director of VC Brokerage, said the market would not improve much in the fourth quarter, which has fewer than 40 days left.

"Things won't truly turn around until we see the end of the tunnel," he said, although investors may have a couple of months that are better than the trend.

"We need to wait and see if the US and China's economy will improve in 2013; that is the only solution for the financial cliff that we face," he said.

Hong Kong Exchanges and Clearing (HKEx) chief executive Charles Li Xiaojia said yesterday that he expected regulatory approval for HKEx's acquisition of the London Metal Exchange (LME) to be finalised early next month. HKEx, which operates the city's stock and futures markets, agreed in June to pay HK$16.67 billion for the LME.

The LME would be a platform to further promote the yuan's globalisation and to tap the business potential of the mainland's commodity derivatives sector, HKEx said at the time.

Tse said that in the long term the acquisition would benefit Hong Kong and the mainland. It would give Hong Kong an edge in its competition with Singapore as an Asian financial hub, he said.

It would also help the mainland's emerging market in metal trading and could serve as a new channel for offshore yuan to be repatriated to the mainland.

"Why should we keep the currency if it has no way to be moved back to China?" Tse said.

"The LME will provide a platform to realise two-way traffic [in the yuan], besides the existing methods, which are inconvenient."