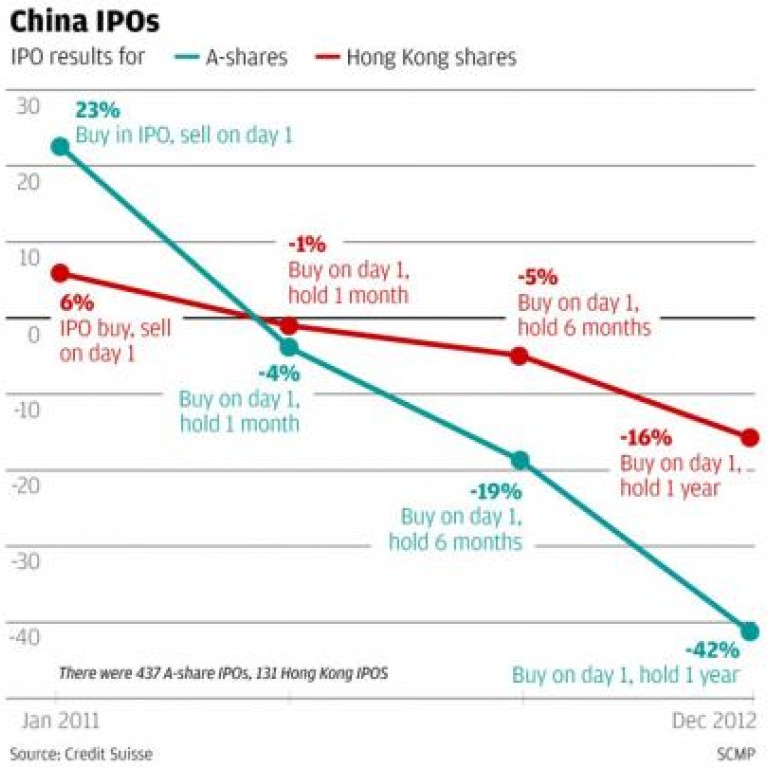

Chart of the Week: China IPOs favouring same-day trading

China's initial public offerings have rewarded investors for selling shares on the first trading day while penalising longer-term holders, a trend that's pressuring regulators to curb insider advantages.

The chart of the week shows the returns at different time frames of the 437 mainland IPOs and 131 in Hong Kong since the start of 2011 to November 28 this year. Mainland investors had an average gain of 23 per cent if they sold IPO shares after one day of trading, while losing an average 42 per cent if they held for a year, according to data compiled by Credit Suisse. Hong Kong IPO holders had a 6 per cent gain if they sold on the first day and a 15 per cent loss after a year, the data showed.

"It's weird that in China the longer you hold new shares, the bigger losses you'll take," says Wu Kan, a Shanghai-based fund manager at Dazhong Insurance, which oversees US$285 million. "IPO shares have been sold at excessively high prices and there have been too many IPOs in recent years. The regulator isn't doing enough to stop overpricing and stem the stock supply. Some reforms on IPOs are needed to ensure more healthy development of China's stock market."

The China Securities Regulatory Commission has suspended issuance of IPO shares since late October as investors' appetite for new stocks waned amid falling share prices. The benchmark Shanghai Composite Index slumped to an almost four-year low on December 3 amid concern an oversupply of new securities would divert funds from existing equities.

Chinese firms raised 757.1 billion yuan (HK$929.6 billion) from IPOs in the mainland in 2010 and 2011, the most for any two years since 1999. IPO proceeds were 98.8 billion yuan this year, the data showed.

The CSRC, under Guo Shuqing, who became chairman last year, has taken steps to bring down initial-offer prices, including seeking pricing advice from individual investors, a process previously restricted to institutional investors. The regulator has, in principle, imposed a cap on price-to-earnings ratios of IPO companies at no higher than 25 per cent more than those of publicly traded companies in the same industry.