Bigger QFII quotas unlikely to draw investors

Mainland stocks not attractive despite proposed expansion of QFII schemes, say analysts

Beijing's expansion of quotas for foreign institutional investors may not be the magic potion that will revive the A-share market, market players have warned.

While the door may be open wider for capital flows from abroad, they questioned whether the equity markets are attractive enough to lure a greater influx.

China Securities Regulatory Commission chairman Guo Shuqing said in Hong Kong this week that quotas for the US dollar-denominated qualified foreign institutional investor (QFII) and renminbi qualified foreign institutional investor (RQFII) schemes could be increased by as much as 10-fold.

At present, the RQFII scheme allows only Hong Kong-listed mainland fund managers to invest their offshore yuan in the domestic equity and bond markets.

Top RQFII fund managers told the that they would seek a larger quota to bring their offshore yuan back to the mainland.

Yet few expressed a willingness to directly invest in A shares, such as by setting up a pure equity fund.

Under the RQFII scheme, 80 per cent of the granted quota must be invested in the domestic bond market; the remainder may be invested in mainland stocks.

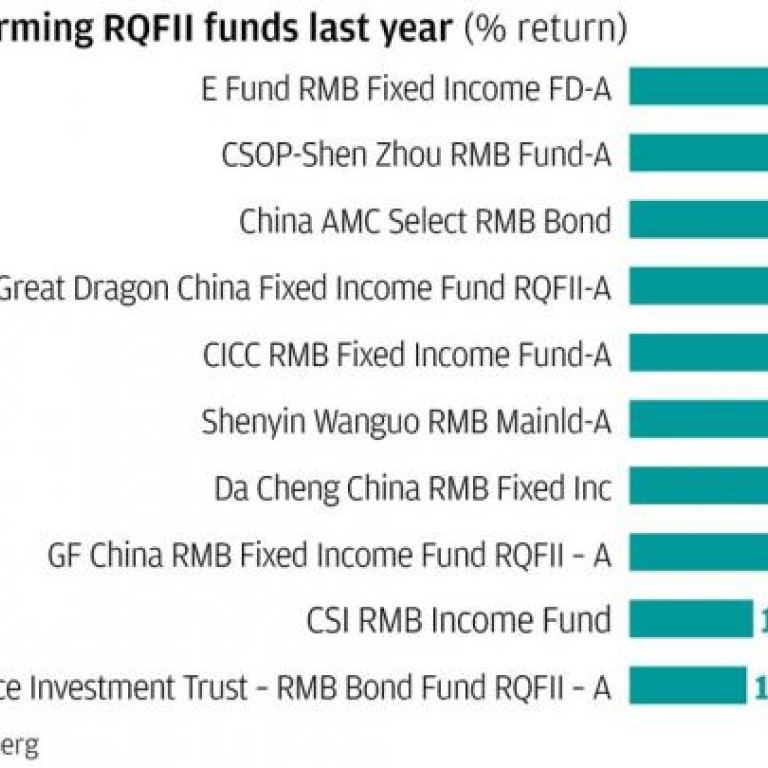

According to data compiled by the , the five Hong Kong-based RQFII fund managers that posted the best investment returns last year all chose to invest their granted quota in the domestic bond market rather than the equity market.

The average investment return of the top five bond funds was 4 per cent, compared with 3.2 per cent for the Shanghai Composite Index.

In the middle of last year, in addition to their bond funds, those Hong Kong-based managers began to launch exchange traded funds (ETFs) that track various mainland equity indices. Still, little capital was channelled into the A-share market.

"Mainland markets are retail-driven, and we are pretty concerned about whether we can draw enough interest from our institutional clients to invest directly on the mainland," warned a major RQFII fund manager.

Renault Kam, a director at GF Asset Management (Hong Kong), said some new RQFII products, like money market funds, could emerge following the expansion of the scheme.

Strategists and fund managers warned that structural problems and banking system risks on the mainland would keep foreign capital cautious about investing in equities.

"Although there is a Chinese recovery story going on in the market and we have seen some near-term gains onshore, the real hurdle - the structural problems - still exists," said Joy Yang, chief Greater China economist at Mirae Asset Securities.