Profit warnings signal poor results season on way

More than 100 profit warnings by Hong Kong-listed firms signal a disappointing set of company results is on its way in March

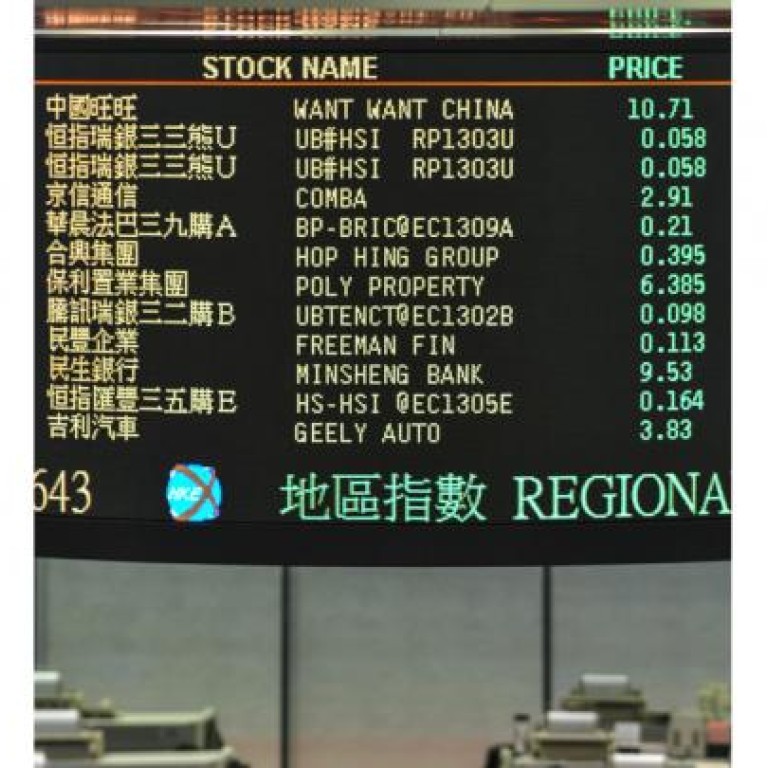

Shareholders have been warned to expect disappointing results announcements when the reporting season for Hong Kong-listed companies gets under way in March, with more than 100 profit warnings issued so far.

A string of warnings of either outright losses or substantial declines in profits followed. As of last Friday, 137 companies listed on the local market's main board had issued pre-announcements on their full-year results, of which 115 were profit warnings and 22 were positive profit alerts.

Announcements from companies listed on the Growth Enterprise Market board bring the total number of profit warnings issued so far to 136. Since there are a total of 1,547 companies listed on the main board and GEM board, about one in 11 of the companies listed in Hong Kong have so far issued profit warnings.

Blue-chip companies have not been spared. The Hong Kong-based consumer goods exporter Li & Fung rattled investors by warning them it expected a sharp drop in core operating profit for last year; and another Hang Seng Index constituent, the fashion retailer Esprit, also warned of a possible loss for the six-month period ended December.

Nor are the woes restricted to the retail sector. Companies involved in resources, information technology, telecommunications and property, and chemical and export-related industries such as manufacturing, transport, and shipbuilding, also warned shareholders to prepare for poor results.

The fibre product manufacturer Silverman Holdings, which is set to announce its first annual results after listing on the main board in July last year, said in a filing on Wednesday that it expected a significant deterioration in last year's results.

Linus Yip, a strategist with First Shanghai Securities, said the economic downturn on the mainland last year caused consolidation in a wide range of industries.

"In almost every industry we could see a 'survival of the fittest' struggle. Some less-competitive companies were hit hard and saw worse-than-expected profits," he said.

The mainland economy stabilised in the fourth quarter last year, but sustainable growth was yet to emerge Yip said. "As the mainland's economy has yet to recover, I don't expect a turnaround in industries such as those that are export-related."

The profit-warning notices provided some hints on the outlook. The shipping container manufacturer and logistics operator Singamas Container said in its announcement that the company's profit would drop substantially because of weakness in the global economy and an expected a downturn in the second half of this year.

Castor Pang, a research head at the brokerage Core Pacific-Yamaichi, said economic weakness and rising costs would continue to cast a cloud over corporate earnings this year. "For example, export-related industries are unlikely to see improvements this year and their operating environment could get even worse," he said.

Even though retail sales had shown some signs of recovering, rises in rents and overhead expenses would continue weigh on the retail industry, both in Hong Kong and the mainland, Pang said. "As a result profit margins will continue to be under pressure."

Sportswear retailers Li Ning and Pou Sheng International and the mainland department store chains Shirble and PCD all issued warnings about their earnings for last year, according to filings to the Hong Kong stock exchange. Pang said he expected more companies to issue profit warnings before the earnings season gets under way in March.

Dickie Wong, an analyst with Kingston Securities, said last year's results were lacklustre, but within expectations. "The momentum now is not that bad compared with 2008, when companies were hit hard by the fallout of the financial crisis," he said.

Not surprisingly the latest profit warnings have hit share prices. Shares in Foxconn International Holdings, the world's largest contract maker of cellphones, dropped 5.6 per cent last week after it warned shareholders to prepare for a net loss for last year. And Li & Fung shares dropped 15 per cent on January 15 when it issued a profit warning after the market closed on the previous trading day.

Wong said share prices were likely to fall again when companies that had issued profit warnings announced their results in March.

Shareholder activist David Webb welcomed the release of information to shareholders, but hoped companies could issue their warnings before the year-end. "You don't suddenly wake up on January 1 and realise that you had a bad year."