Scrap metal giant CMR denies fraud allegation by US firm Glaucus

CMR shares suspended after Glaucus Research claims firm has 'deceived market' over its size

The company that claims to be the largest scrap metal recycling operator in China has denied allegations of fraud made by the American short-seller Glaucus Research Group.

China Metal Recycling (Holdings) (CMR) is the largest mainland scrap metal recycling company in China, based on its 2008 revenue, according to a survey by the China Association of Scrap Metal Utilisation.

However, Glaucus, in its latest report, said: "CMR purports to be the largest scrap metal recycling company in China. We believe this is a lie. Publicly accessible import data from the Chinese government suggests CMR is a blatant fraud that has deceived the market about the size of its business."

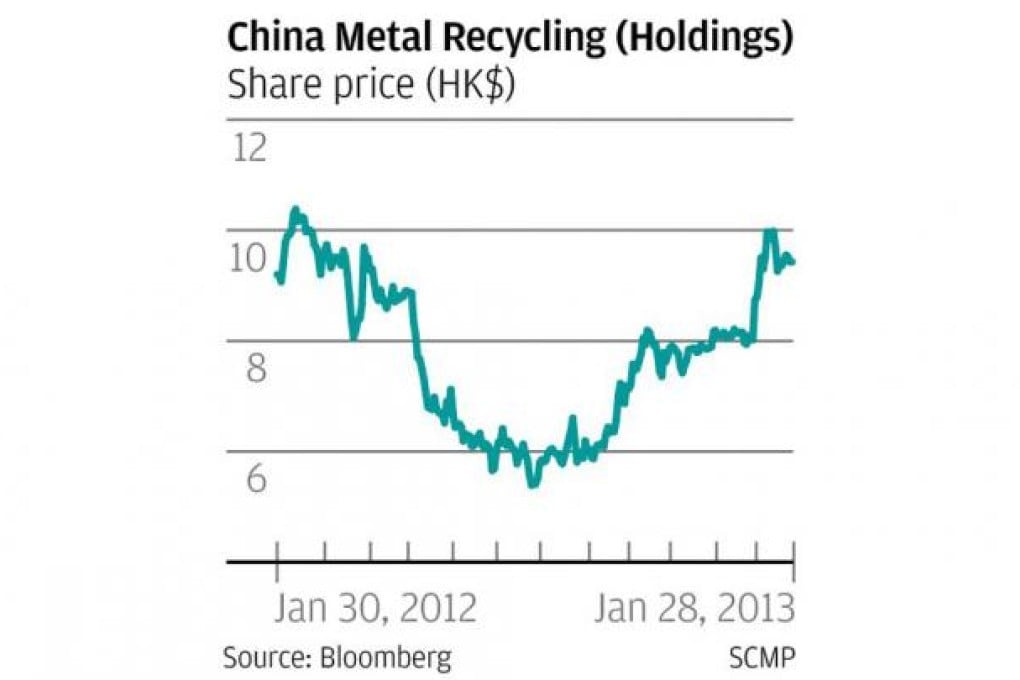

CMR, which is listed on the Hong Kong stock exchange, said the allegations were "completely inaccurate and wholly unfounded". CMR's shares were suspended yesterday, pending a clarification statement on Glaucus' allegations. Glaucus put a target price on CMR shares of precisely HK$0. CMR's share price has risen from HK$6.02 on July 16 last year to HK$9.43 yesterday.

To produce its reported output, CMR needs to import 1.44 million tonnes of non-ferrous scrap metal a year, but data from China's Ministry of Environmental Protection indicates CMR has never been legally allowed to import more than 87,500 tonnes a year, Glaucus alleges.