HKEx eyes turnover boost after LME deal

Mainland demand for commodities will fuel turnover, says chairman

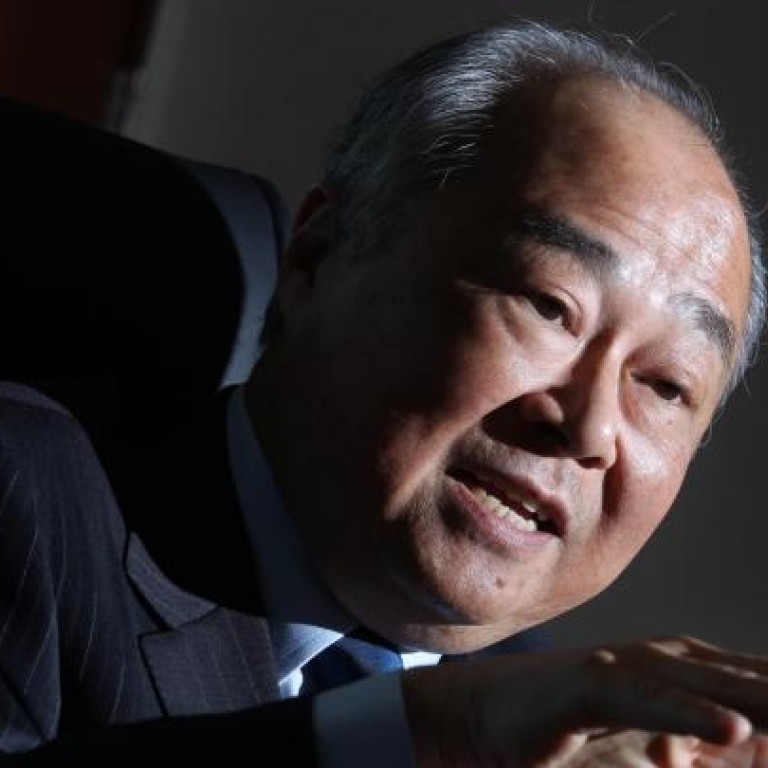

Hong Kong Exchanges and Clearing, the local stock and futures markets operator, expects turnover at the newly acquired London Metal Exchange to continue rising as a result of increasing demand for commodities from China, chairman Chow Chung Kong told the .

The exchange would now need to focus on integrating with the LME, including helping the London bourse complete its move from a profit-constrained business model to a commercial one, he added. In terms of management and brand name, Chow does not think HKEx needs to merge the two exchanges.

"LME is a good brand and it has a team of experienced managers. We can let it run independently but there would be some crossover of directors," he said.

Chow is now a director of LME, and Martin Abbott, while remaining chief executive of LME, has become co-head of HKEx's newly created global markets division, which oversees the equities, fixed-income, currency and commodities businesses, including the LME.

Chow said the HKEx would help LME to set up its own clearing house and assist it in expanding in China and other Asian markets. LME, which has warehouses around the globe for physical delivery, does not have a presence in China.

He also said LME would add Asia trading time zones while HKEx would introduce a platform to trade LME products.

"HKEx's background and connection would help the LME to develop in Asia," Chow said. "Likewise, the experience and platform of the LME would allow HKEx to develop into commodities trading."

HKEx in December completed its £1.39 billion (HK$16.94 billion) takeover of the London Metal Exchange, the world's largest base metals exchange. LME traded US$15.4 trillion worth of contracts in 2011. It handles a range of metals from aluminium to copper and tin.

The LME deal allowed HKEx, which now receives 75 per cent of its income from equity trading, to enter the commodities business, which it hopes will yield half of its income in a few years' time when combined with the fixed income and currency businesses.

Chow said HKEx and LME may co-operate with their mainland counterparts in the future.

"As an example, the LME can work with the Shanghai Futures Exchange on how to co-operate to develop their commodities trading further," he said.

He noted HKEx and the Shanghai Stock Exchange and Shenzhen Stock Exchange had set up a joint venture in September to launch indices and index products. The same could be done in cross-border commodities development. "Hong Kong and Shanghai can be partners in many projects," he said.

Analysts believe Shanghai, where there are plans to launch an international board to allow international big names such as HSBC and Coca-Cola to list, is set to be a threat to HKEx.

Chow thinks differently, however. "Hong Kong is an international city that has a well-established legal system and banking network that have been used by many international investors," Chow said.

"Hong Kong still has its competitive edge."